Welcome 2023 - The Year of Crypto Resurgence

Armed with the lessons and learnings of a brutal 2022, we here at Stormrake head into 2023 with cautious optimism.

The information contained here is for general information only. It should not be taken as constituting financial advice. Stormrake is not a financial adviser. You should consider seeking independent financial advice prior to making any personal investments.

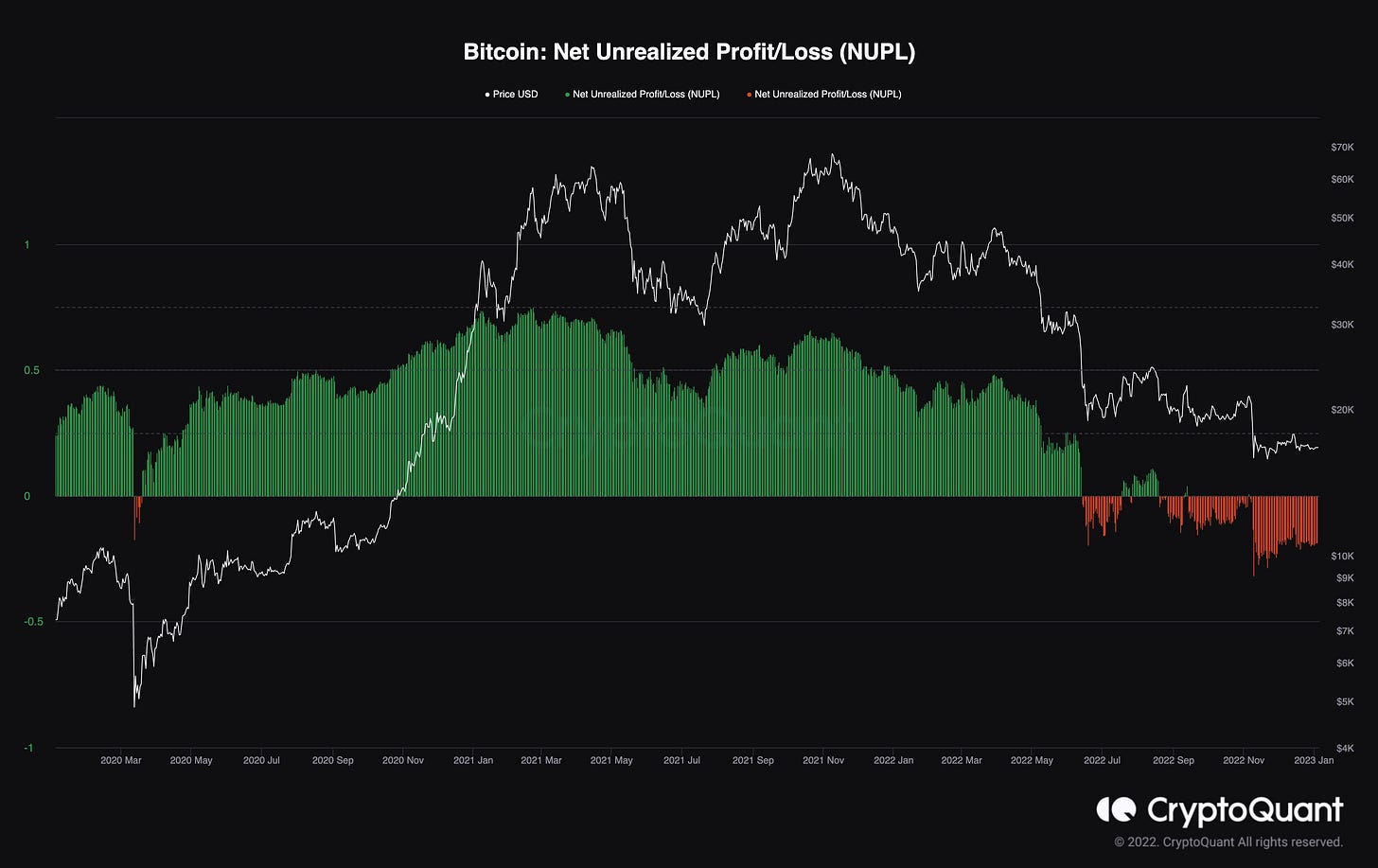

Bitcoin: Net Unrealized Profit/Loss

According to CryptoQuant, "Net Unrealized Profit and Loss (NUPL) is the difference between market cap and realized cap divided by market cap. Assuming that the latest coin movement is the result of a purchase, NUPL indicates the total amount of profit/loss in all the coins represented as a ratio. It could be interpreted as the ratio of investors who are in profit." We're now in a period where the NUPL has been in a sustained period of loss, not seen since the 2018 bear market and indicates less selling pressure. What's also important to note is sustained periods of drawdown precedes bull markets, as coins change hands to new holders who are now in profit and the timeline lines up with a new Bitcoin halvening cycle.

Ethereum Supply Imbalance

Ethereum post merge continues to hold up astonishingly well when compared to its competition, the so-called "ETH killers" such as Solana and Avalanche. Now a slightly controversial take that might rile up the Bitcoin maxi community, there is a structural imbalance between the Bitcoin and Ethereum supply structures. Without subscribing to the "ultra sound money" meme circulated by the ETH maxi community, we can look at the last 6 months of price action performance to validate our hypothesis. Whilst Bitcoin has shed approx. 22.5% of its value, Ethereum held strong and only shed 0.8% of its value over the same time period. Bitcoin had also set new lows in 2022 following the FTX collapse, whilst ETH still trades nearly 40% over its 2022 low. This will be one of the most interesting dynamics to watch as 2023 unfolds.

BTC/USD Key Levels

Bitcoin has remained perfectly locked for the last two weeks, looks like everyone is actually taking a holiday and putting the charts away. Whilst we remain between $16,500 and $17,300 USD the range will continue and there will be very little volatility to extract value from. A breakdown below $16,500, we will watch for a sharp move towards $15,588 before major support kicks in at the 2022 lows. To the upside, if we close above $17,300 we will look for a continuation towards $18,217 before major resistance comes in to slow momentum.

ETH/USD Key Levels

Ethereum remains rangebound between $1,190 and $1,230 USD. If we can manage to get a clean break and daily close above $1,230 then a sharp move towards the $1,300 - $1,341 pocket can be expected. With enough momentum, we can see a retest of $1,472. To the downside a break and close below $1,190, we can see a move towards $1,130. If the downside move is particularly strong, we can anticipate a retest of $1,071.

To view this article and many others on our blog - please click HERE

If you enjoyed this Morning Note, feel free to open an account and gain access to more proprietary research and work with your very own dedicated crypto broker.

Disclaimer

All statements made in this material are made in good faith and we believe they are accurate and reliable. Stormrake does not give any warranty as to the accuracy, reliability or completeness of information that is contained here, except insofar as any liability under statute cannot be excluded. Stormrake, its directors, employees and their representatives do not accept any liability for any error or omission in this newsletter or for any resulting loss or damage suffered by the recipient or any other person. Unless otherwise specified, copyright of information provided in this newsletter is owned by Stormrake. You may not alter or modify this information in any way, including the removal of this copyright notice.