Three Key Bitcoin Prices to Watch This Week

Bitcoin has three key levels to watch, driven by option expiries, ETF buying and the yearly open.

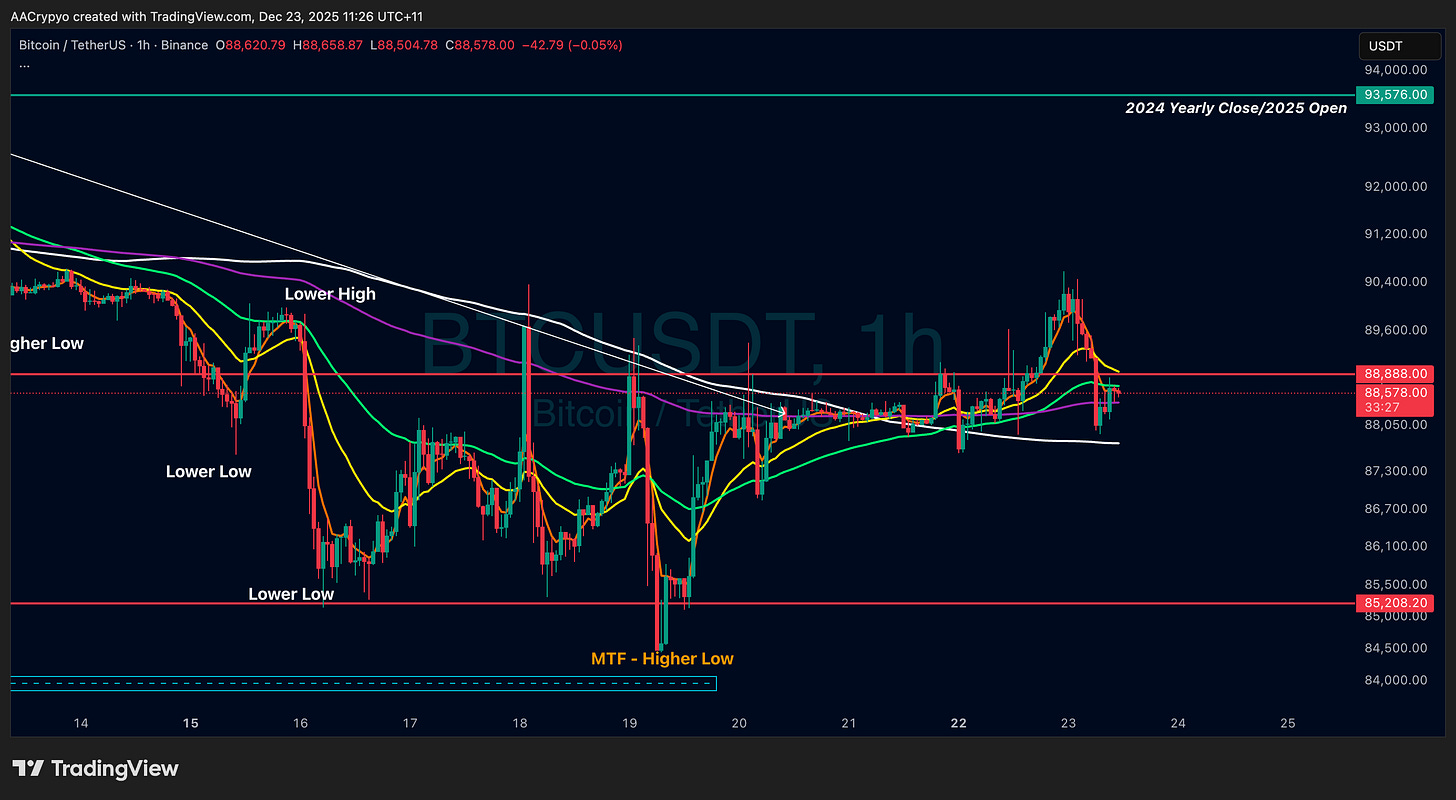

As we enter the final stretch of the year and the Christmas and holiday period sets in, market volumes, liquidity and order book depth typically decrease. This has been clearly reflected in price action, but we may now be seeing signs of volatility returning. Bitcoin briefly reclaimed $90K yesterday, gaining over 2% intraday, but once again closed around $88K which has acted as a magnet for over a month.

Looking ahead to the end of the week, there are three key price levels to keep an eye on. Yesterday we discussed max pain for Bitcoin options which currently sits near $96K. For those unfamiliar, max pain refers to the strike price at which the largest number of option contracts expire worthless. This creates an incentive for bulls to push the price higher in an attempt to minimise losses. At the same time, the yearly open at $93.5K remains a major area of resistance that bears have successfully defended throughout the entire consolidation period.

To the downside, support remains around $83K to $84K. This area not only aligns with the recent higher low defended by bulls last week, but also matches the average entry price of spot Bitcoin ETF buyers, according to Glassnode. This likely explains why bulls have been so determined to protect this zone from further declines.

In summary, the levels to watch over the coming sessions are $93.5K and $96K to the upside, and $83K to $84K to the downside. These represent the key zones that align with market structure, ETF positioning and option expiry pressure. Although volumes and liquidity are low during this time of year, it gives either side more opportunity to step in and makes it easier to push price in their desired direction.

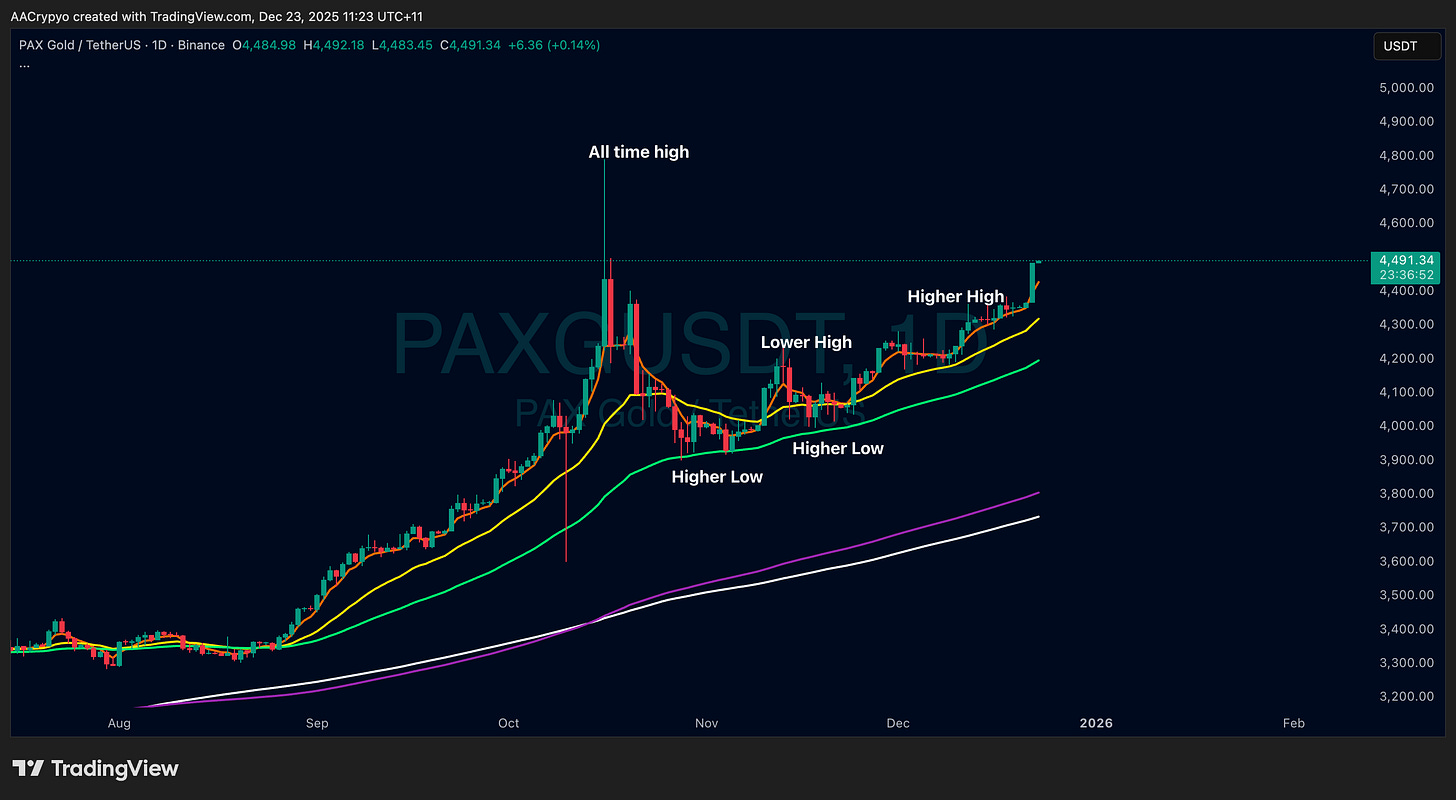

Stormrake Spotlight: Pax Gold (PAXG) ($4,491)

PAXG has not only reached our $4,400 target but surged past it with a gain of nearly 3% over the last 24 hours. It has now posted its highest daily close ever. Despite sitting at all time highs, the strength behind the move remains impressive and could continue for the foreseeable future.

BTC/USD Key Levels and Price Action:

Bitcoin pushed above $90K yesterday as bulls tried to extend their momentum. However, the rally failed once again to hold above $88,888, and the bears regained control. This remains the key battleground and will likely determine whether price moves towards $93.5K to $96K, or drops back towards the $83K to $84K region.

BTC Total ETF Flows for 22 Dec: - $75.8 million

(ETF flow data is sourced from https://farside.co.uk/btc/ and reflects figures at the time of writing.)

*All prices are denominated in USD unless stated otherwise*

Written by Alexandar Artis

To view this article and many others on our blog - please click HERE

If you enjoyed this Morning Note, feel free to open an account and gain access to more proprietary research and work with your very own dedicated crypto broker.

Disclaimer

All statements made in this material are made in good faith and we believe they are accurate and reliable. Stormrake does not give any warranty as to the accuracy, reliability or completeness of information that is contained here, except insofar as any liability under statute cannot be excluded. Stormrake, its directors, employees and their representatives do not accept any liability for any error or omission in this newsletter or for any resulting loss or damage suffered by the recipient or any other person. Unless otherwise specified, copyright of information provided in this newsletter is owned by Stormrake. You may not alter or modify this information in any way, including the removal of this copyright notice.

Positive; we survived a very turbulent year and 2026 is incoming