The merge is now complete

An incredible achievement occurred within the crypto space as the ETH chain transitioned to Proof-of-Stake. Ideologies aside, this is a testament to the ETH dev team as it was a flawless transition.

The information contained here is for general information only. It should not be taken as constituting financial advice. Stormrake is not a financial adviser. You should consider seeking independent financial advice prior to making any personal investments.

Back to business

The team at Stormrake battened down the hatches and ensured reliable trading conditions throughout the whole merge. As a testament to the ETH dev team the merge occurred without any issues. As one of the most insanely hyped events in crypto history, it would have required something truly extraordinary to meet expectations but in the end it was anti-climactic. We have to head back to the trading room and strategise how we can win in this hostile macro environment.

A note on ETHW

Due to the successful merge of ETH transitioning to Proof-of-Stake, a hard fork occurred and now we have a Proof-of-Work consensus model as well. What this means for the everyday investor is that there is now a new token with the ticker symbol ETHW available to trade. All ETH wallets at the time of the merge were airdropped the ETHW token on a 1:1 basis based on their balance. At the time of writing ETHW is worth approx. $9.11 USD giving it a relative value of 0.61% compared to ETH.

Unfortunately the writing is on the wall and this token will trend to zero over time, unless it catches fire as some sort of meme coin. If you were airdropped this token, you just have to time your sale to maximise extractable value.

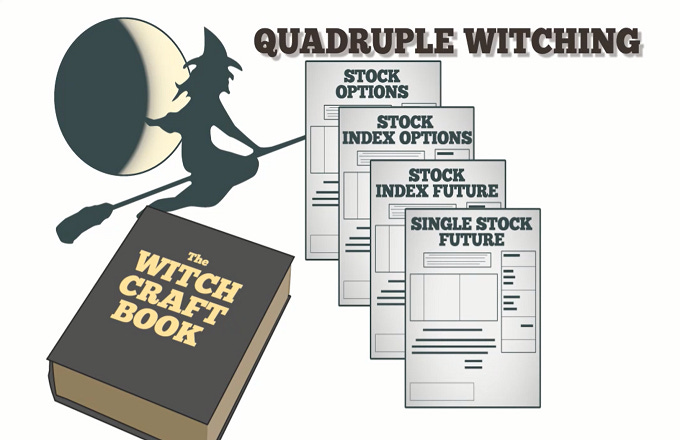

Quadruple witching

The term quadruple witching refers to the date on which certain derivatives contracts expire simultaneously. This happens with four different types of contracts, including stock index futures, stock index options, stock options, and single stock futures. Quadruple witching dates occur four times a year on the third Friday of March, June, September, and December. All this means we should prepare for high volatility today, plus expect it to spillover into the weekend through the only 24/7 market that is cryptocurrencies.

BTC/USD key levels

Bitcoin is yet again trading just above $19,560 USD. Cast your mind back only a week ago to the low volatility price action when this price level became a magnet, we would tick up a few percentage points and get sucked back to this demand zone. I would be cautious as a breakdown of $19,560 could cause a sharp sell-off to $18,549.

A rally can occur if we reclaim $20,792 but that in itself will require a 5% rally, a reclaim of $20,792 and expect a slow stair walk to $22,704.

ETH/USD key levels

Ethereum has its back against the wall despite a successful merge. This is a classic occurrence of buy the rumour, sell the news. Now that expectations have met reality, the sell pressure should be absorbed as the decreasing supply narrative starts to take hold for Ethereum. $1,500 USD is pivotal to reclaim, should this happen a sharp move to $1,620 and an overshoot to $1,700 cannot be ruled out. On the downside, we will be watching the local low of $1,422 to break for an aggressive sell-off to $1,333. If we get a sharp reduction in On Balance Volume, watch for a retest of $1,241 as the next key support level.

Disclaimer

All statements made in this material are made in good faith and we believe they are accurate and reliable. Stormrake does not give any warranty as to the accuracy, reliability or completeness of information that is contained here, except insofar as any liability under statute cannot be excluded. Stormrake, its directors, employees and their representatives do not accept any liability for any error or omission in this newsletter or for any resulting loss or damage suffered by the recipient or any other person. Unless otherwise specified, copyright of information provided in this newsletter is owned by Stormrake. You may not alter or modify this information in any way, including the removal of this copyright notice.