The long winter has only just started

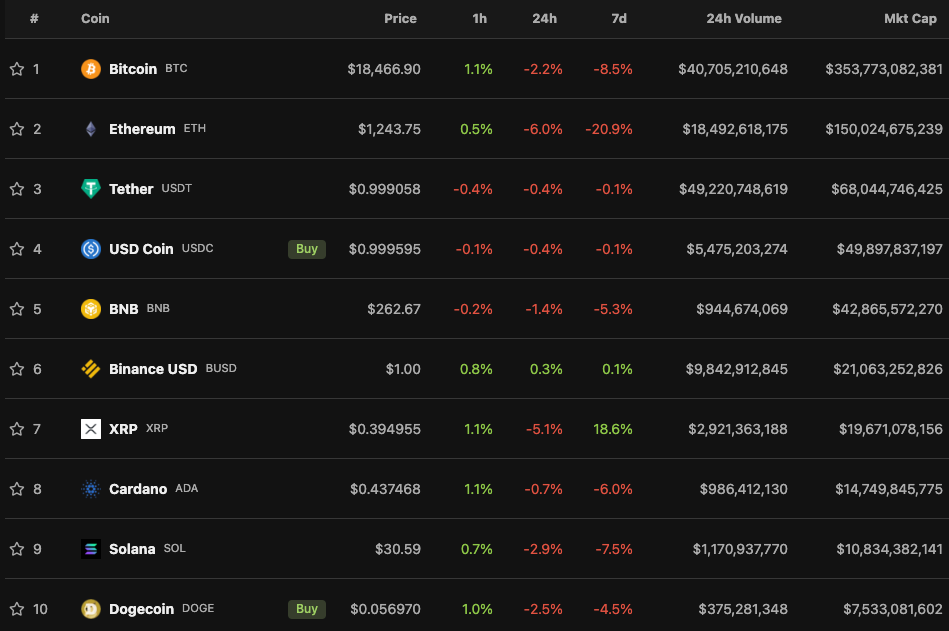

Many crypto pundits had called the bottom in the June '22 liquidation cascade, yet BTC is currently trading 5% higher from that local low. Today's Morning Note dissects whether we will make new lows.

The information contained here is for general information only. It should not be taken as constituting financial advice. Stormrake is not a financial adviser. You should consider seeking independent financial advice prior to making any personal investments.

75bps to digest

US official interest rates have just hit 3.25% which is the highest level it has seen in more than 14 years. This is a lot for the market to digest and means we should be expecting further tightening, as long as inflation remains above the effective FED funds rate. It won’t be pleasant for risk assets and with DeFi lending rates on stablecoins barely above 1.5% and US 2yr treasury above 4%, the exodus from the DeFi world back to TradFi will likely continue.

Ethereum struggling to find a bid

ETH continues to be sold relentlessly post merge. We always had a strong feeling that it was going to be a “sell the news” event but the sheer size of the sell-off is quite impressive to say the least. For context, it is the worst performing coin in the top 20 and within the top 100 only Ravencoin, Luna and Luna Classic have put in worse returns in the last week.

Are you a buyer?

Taking out the symbol details to avoid bias, would you consider being a buyer of the chart above? Only considering the technicals, it looks like an attractive bid as it’s coming into a resistance level, which if it clears will look to head much higher. Unfortunately for us crypto investors, that is the inverted Bitcoin chart meaning we should anticipate some more pain before this winter ends.

BTC/USD key levels

Bitcoin at these levels is a precarious long, it has remained at the $18,549 USD level despite a brief sell-off following the 75bps rate hike out of the FOMC. This does show some short term strength. Closing above this level would indicate a likely retrace towards $19,560. If we catch a strong enough bid and rip through $19,560, the next major resistance comes in at $20,554. To the downside it’s a very simple trade. If we break and close below the local low of $17,647, it’s a straight shot $16,666 and then free fall below that level (if we close below).

ETH/USD key levels

Ethereum key levels highlighted in yesterday’s Morning Note have held up quite nicely and $1,241 USD has provided a local support level. If we hold here, expect a fade of the FOMC sell-off right back to $1,333, with enough momentum the major resistance level of $1,422 can get retested. To the downside, it’s a clear trade if we close below $1,241 as we’ll shoot straight to $1,111. Major support comes in at $1,003 and can be tested if we get an hourly candle close below $1,111.

Disclaimer

All statements made in this material are made in good faith and we believe they are accurate and reliable. Stormrake does not give any warranty as to the accuracy, reliability or completeness of information that is contained here, except insofar as any liability under statute cannot be excluded. Stormrake, its directors, employees and their representatives do not accept any liability for any error or omission in this newsletter or for any resulting loss or damage suffered by the recipient or any other person. Unless otherwise specified, copyright of information provided in this newsletter is owned by Stormrake. You may not alter or modify this information in any way, including the removal of this copyright notice.