The great unwind that has yet to happen

Central banks across the globe have been promising higher interest rates and quantitive tightening for some time now, although they have delivered on the former, the latter is yet to be seen

The information contained here is for general information only. It should not be taken as constituting financial advice. Stormrake is not a financial adviser. You should consider seeking independent financial advice prior to making any personal investments.

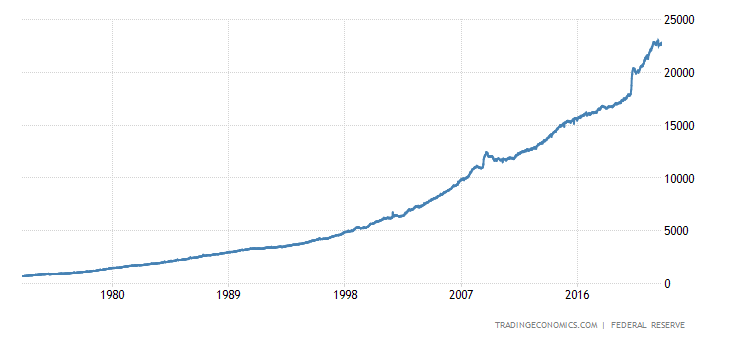

US FED Reserve balance sheet

The chart above is the long term growth of the FED Reserve balance sheet that has been going on for the better part of 45 years. They have been trying their best to spook the markets into believing they really are going to embark on relentless quantitive tightening to fight inflation. Other than letting shorter term duration bonds mature without rolling them over they haven’t really unwound their balance sheet. The great unwind if/when it truly starts in earnest will be quite damaging to the global financial markets and may provide the final leg of this bear market to finally be well and truly over.

AUS RBA balance sheet

The chart above shows a similar story occurring right here on our home soil in Australia as the RBA has yet to truly unwind their balance sheet. As we can see, the RBA response to the Coronavirus crisis had them buying bonds with fury as their balance sheet went parabolic. If/when they follow suit with the US and truly begun unwinding their positions, what will happen to the ASX and our local bond market, when the buyer of last resort is now the largest seller?

Bitcoin key levels

Bitcoin has now well and truly been rejected off the 25k handle and is now heading towards to the 22.4k support level. Should it break and close below 22.4k then the ascending channel we have been in since the lows will become invalidated and we would enter a shorter term bearish structure, as it will be on to the Bitcoin bulls to show their resolve and start hitting the offers, a failure to do so can have us retesting the key 20k level.

Ethereum key levels

Ethereum has now established a short term bearish structure as it failed to clear the 2k level and has now broken below 1888 with the next key level of support coming all the way down at 1700.

A secondary concern is the descending channel that has now formed but could be a boon for traders, as they can accumulate spot ETH through buying bounces off the lower channel and selling the upper channel retests as it potentially heads to 1700.

The Merge is still very much a bullish catalyst set to occur on September 15th - 16th and I wouldn’t rule out massive spikes to the upside that would quickly invalidate the channel and trigger a reclaim of 2k.

Inflation fight still underway

Whilst it’s pretty easy to get caught up in crypto land with all the volatility and breaking developments, it’s still important to take a step back and take heed of the wider macro picture.

The whole world is battling against inflation and the cost of living pressures are rising.

As seen in the chart above, 600 bps spread between the US interest rate and headline inflation rate.

This is a clear signal that we should anticipate more rate hikes and be wary of any uptick in inflation prints as that could cause widespread panic in risk assets and more aggressive rate hikes coming from the FED. As this massive 600 bps spread is attempted to tighten, risk asset prices can get beaten up but we should watch carefully for an inversion in US inflation rate and their core interest rate as that would be an early signal to get risk on again and max bid risk assets such as cryptos and equities.

Disclaimer

All statements made in this material are made in good faith and we believe they are accurate and reliable. Stormrake does not give any warranty as to the accuracy, reliability or completeness of information that is contained here, except insofar as any liability under statute cannot be excluded. Stormrake, its directors, employees and their representatives do not accept any liability for any error or omission in this newsletter or for any resulting loss or damage suffered by the recipient or any other person. Unless otherwise specified, copyright of information provided in this newsletter is owned by Stormrake. You may not alter or modify this information in any way, including the removal of this copyright notice.