So close yet so far

Crypto traders have entered a triathlon of events, US CPI, The ETH Merge and Fork will all occur within the next 72 hours. With one event down (CPI), it's not looking good but we're up for the fight!

The information contained here is for general information only. It should not be taken as constituting financial advice. Stormrake is not a financial adviser. You should consider seeking independent financial advice prior to making any personal investments.

Inflation print comes in hot

Core inflation rate in the US accelerated and this caused crypto and equities to have a brutal day in the office. S&P500 dropped 4.5%, NASDAQ dropped 5.5%, Bitcoin dropped 10%, Ethereum dropped 8.5% and it was pure one directional selling, with not a single bounce along the way. As mentioned earlier, it was brutal. The sheer drop was caused by concerns that now the FED not only has to hike 75bps but might have to accelerate their tightening cycle. Obviously this doesn’t bode well for risk assets and we can expect further downside pressure with a week until the FED meeting occurs. Sticky inflation is a difficult beast to slay but during this fight, keep your eyes on the prize and secure some cheap crypto assets.

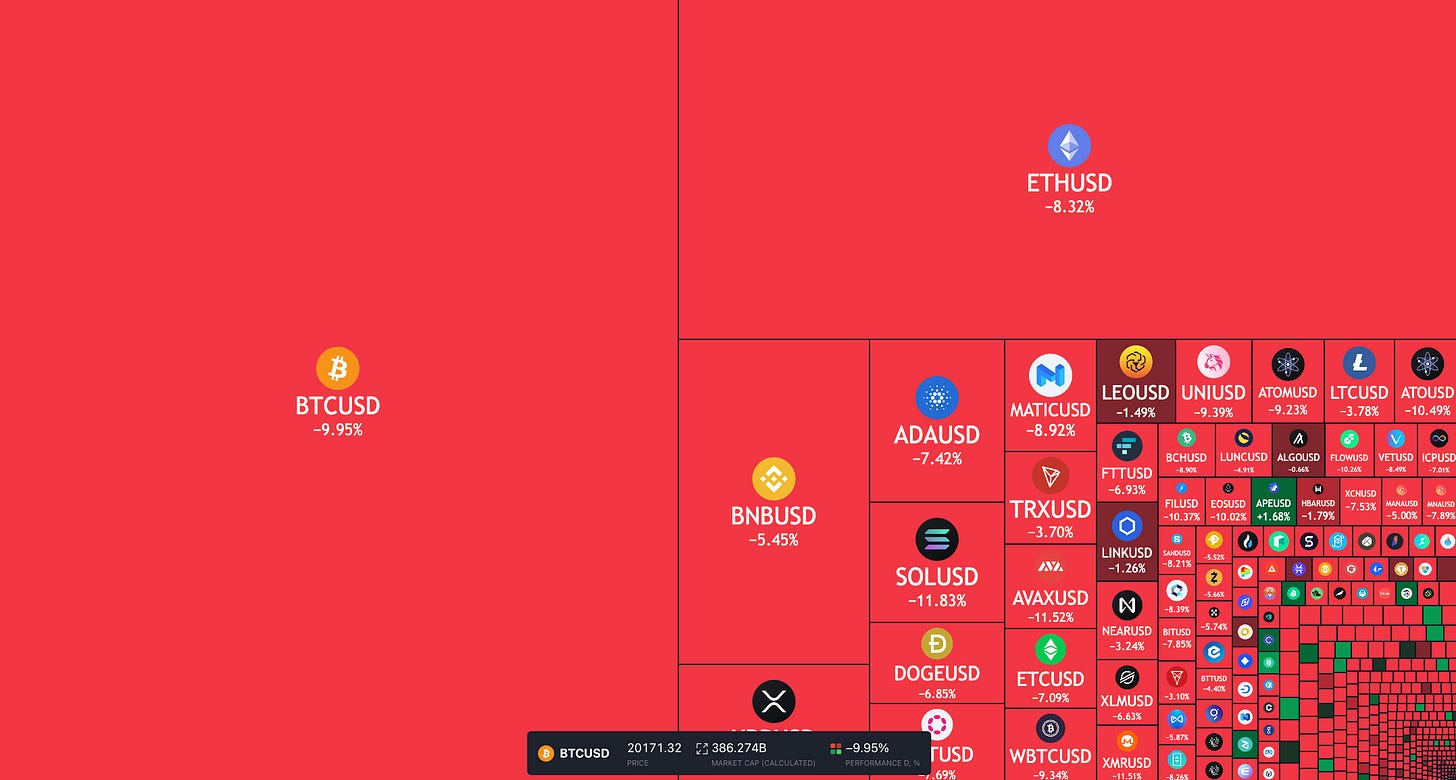

A sea of red

As we can see the crypto market had caught quite a beating, with BTC as one of the worst performers within the top 20 coins. The stock market also had $1.6 trillion USD worth of value wiped off yesterday. There are discounts here but it would be wise to throw limit orders in and wait for the market to come to you, as it’s unlikely that we get a bullish reversal occurring any time soon. Let’s also be mindful of the merge and the potential ETH fork happening within the next 48 hours, the volatility has only just begun and now is not the time to get battle weary.

BTC/USD key levels

The levels from yesterday’s Morning Note remain unchanged but they played out to perfection during the CPI volatility. $22,704 USD proved to be the exact turning point for the market as the announcement came shortly after and proceeded to dump 10%, slicing through the $20,792 key level. As explained in yesterday’s Morning Note, when this occurs we can expect a continuation towards $19,560. Further support comes in at the $18,549, the local low that was set before the relief rally occurred.

For a move to the upside, we need a strong bullish reclaim of the $21,761, this will require a 7.5% rally. A catalyst such as an unsuccessful merge, with a flight to safety into BTC being the likely cause.

ETH/USD key levels

Yesterday’s Morning Note provided the exact support level we are currently trading at the time of writing this article. Support came in at $1,552 USD and our highlighted key support level was $1,559. The decision for the market now is if we close below $1,559 the next key support level kicks in at $1,422. Any issues with the merge and a lot of weakness can come in, taking us to $1,241 as a major support level. A successful merge can take us back up to $1,702, retracing yesterday’s inflation print sell-off, bringing in new bidders and supporting a stronger rally.

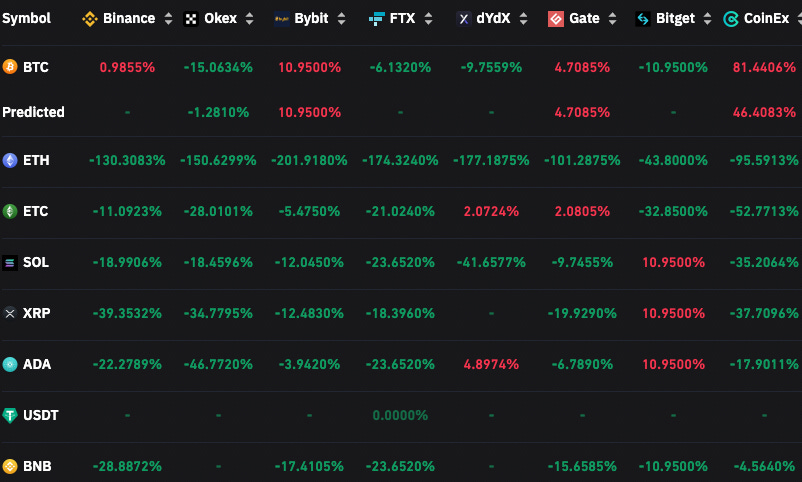

Funding rates get blown out

ETH funding rates are continuing to get blown out heading into the merge. This is due to one of the most crowded trades of the year, as traders pile into delta neutral positions aiming to maximise the potential airdrop of an ETH fork token.

The funding rates to be short on ETH will continue to rise heading into the merge and will probably collapse within the first few hours post merge. For anyone attempting to play the derivatives market right now, only do so if you know exactly what you’re doing, as these markets are only going to get more peculiar.

Make decisions on your spot portfolio and have the conviction to see them through, or better yet contact your broker at Stormrake and have your plan ready to execute.

Disclaimer

All statements made in this material are made in good faith and we believe they are accurate and reliable. Stormrake does not give any warranty as to the accuracy, reliability or completeness of information that is contained here, except insofar as any liability under statute cannot be excluded. Stormrake, its directors, employees and their representatives do not accept any liability for any error or omission in this newsletter or for any resulting loss or damage suffered by the recipient or any other person. Unless otherwise specified, copyright of information provided in this newsletter is owned by Stormrake. You may not alter or modify this information in any way, including the removal of this copyright notice.