Patience is a virtue

The global financial markets have been quite messy as of late and to discern the direction of them will require a ton of patience. Today we examine where patient investors can benefit the most

The information contained here is for general information only. It should not be taken as constituting financial advice. Stormrake is not a financial adviser. You should consider seeking independent financial advice prior to making any personal investments.

Liquidity landscape

It might not look like much compared to the parabolic run of USD supply in the pandemic era, however USD liquidity conditions have stagnated. This isn’t the quantitative tightening that the FED has been warning about but even this flatlining of liquidity has caused risk assets to get beaten down.

With this backdrop in mind, it’s important to note that if central banks around the world embark on their QT programs in order to curb inflation, almost all asset classes are going to experience a world of pain. This shouldn’t be seen as a need for fear though, for the patient investor, if sufficiently capitalised can swoop in and secure superb entries. It’s not to say that we need to time the market to perfection but simply need to lay out a course of action to enter when the right discounts present themselves. What does the right discount look like? For that we need to check the tape and the charts.

Pulse check

Bitcoin closed the monthly candle down 13.99% at $20,053 and Ether closed the monthly candle down 7.46% at $1,554.

Bitcoin dominance by market capitalisation declined by 4.45% in August, leaving BTC 40.16% dominant at the monthly candle close. As observed in ETH's outperformance of BTC on the month, the ETH / BTC pair closed 7.59% higher at $0.078.

With total crypto market cap down 9.93% or -$105.2B on the month, we're now seeing $954.4B in the crypto markets.

BTC has been grinding sideways since the last update, finding support from the 2017 ATH at $19,925, but also failing to break above $20,600. Very narrow range overall. This sets markets up for a technical breakout to either level, this shouldn’t cause FOMO buys to the upside and FEAR selling if a downside breakout occurs.

ETH price is converging around the middle of the trading channel between $1,421 and $1,733. Neutral RSI on the 4H, while momentum indicators such as stochastic RSI and MACD seem to suggest prices are more likely to drop at this stage.

Bitcoin key levels

Looking at BTC from a higher timeframe shows us the contraction in prices setting us up for a breakout. A decision will be made in the market around this 20k level, for those patient enough, a breakdown below 20k can see us retest the recent low and can have investors scooping up cheap BTC. An upside scenario where we breakout can have us revisit the range between 21.7k and 22.7k, this means that even if we wait and track higher we don’t face a massive risk of being sidelined.

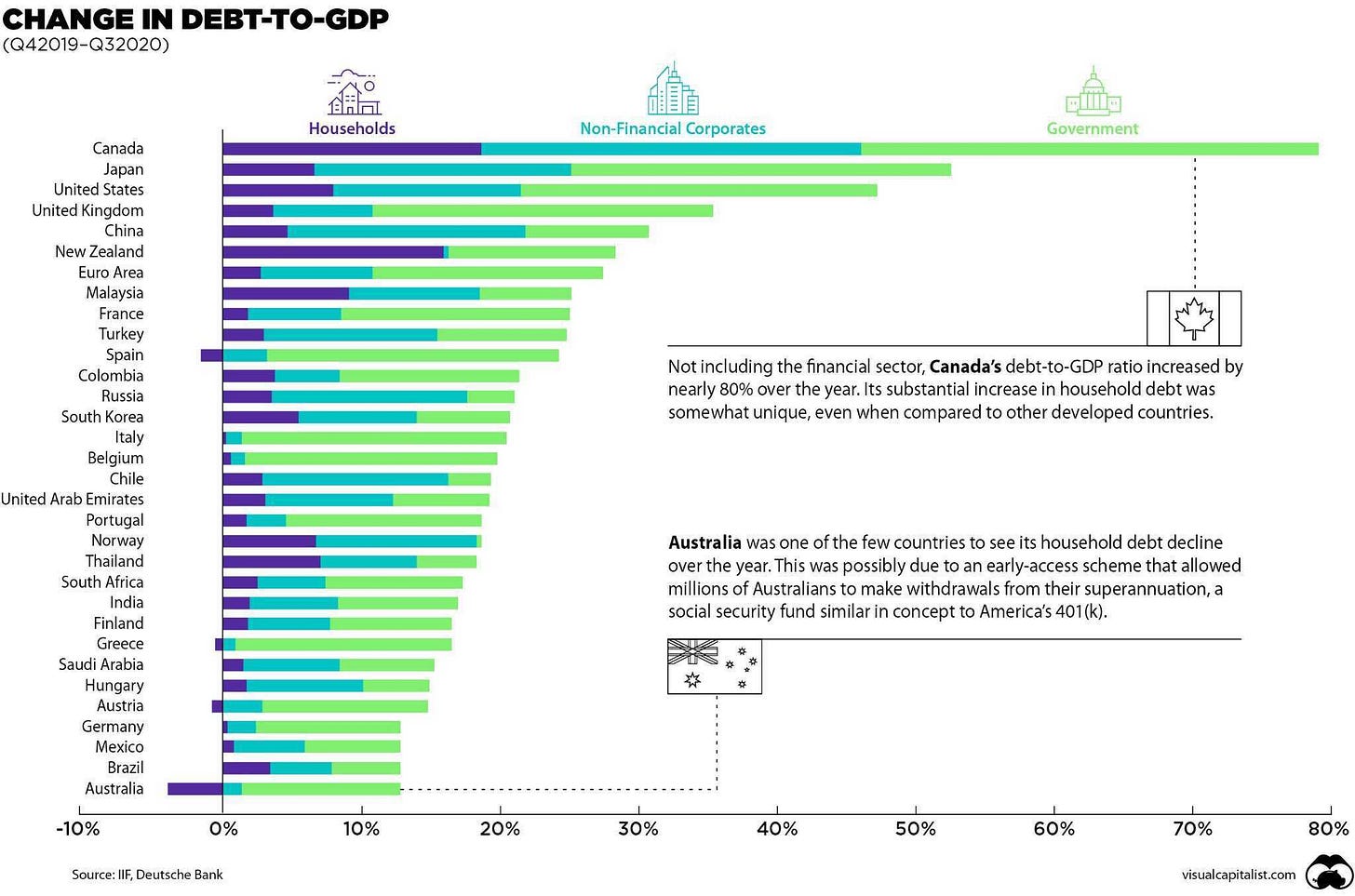

Debt bubble

To support people whose finances were adversely impacted by COVID-19, the Australian Federal Government allowed people to access up to $10,000 of their superannuation between 20 April and 30 June 2020, and a further $10,000 in the second application period from 1 July to 31 December 2020. Over the duration of the early release of superannuation program, a total of 3.5 million initial applications and 1.4 million repeat applications were approved, with an average value of $7,638 per application and a total value of $36.4 billion.

Australian Prudential Regulation Association [APRA], 2021).

Central banks around the world will be watching these debt levels in order to help guide their policy. This can provide us with a leading indicator, as central banks will continue to raise rates until enough “pain” is experienced to bring debt levels under control. This cycle will inevitably have something “break” and this unknown catalyst will force the central banks to ease policy, this could be the bat signal for risk assets to fly.

In the news

Disclaimer

All statements made in this material are made in good faith and we believe they are accurate and reliable. Stormrake does not give any warranty as to the accuracy, reliability or completeness of information that is contained here, except insofar as any liability under statute cannot be excluded. Stormrake, its directors, employees and their representatives do not accept any liability for any error or omission in this newsletter or for any resulting loss or damage suffered by the recipient or any other person. Unless otherwise specified, copyright of information provided in this newsletter is owned by Stormrake. You may not alter or modify this information in any way, including the removal of this copyright notice.