More Tariffs, More Pain: Bitcoin Slides Lower

Trump announces EU tariffs, triggering market panic and a sell-off.

We started the month with trade wars brewing between the United States and Canada, Mexico, and China. Now, as February comes to a close, Trump has extended tariffs to Europe, announcing 25% tariffs on the region.

Just as we saw at the beginning of the month, markets reacted sharply. Within the first hour, the S&P 500 fell 0.78%, wiping over $500 billion in market cap, while the Nasdaq dropped 0.94% and Bitcoin over 3%. Bitcoin officially closed the day down 5%, hitting an intraday low of $82,250—its lowest price since 11 November. That marks four consecutive red days, hardly the way most envisioned closing out February.

New Tariffs by the United States:

25% tariffs on Canada

25% tariffs on Mexico

25% tariffs on the EU

10% tariffs on China

(Potential) 100% tariffs on BRICS

These tariffs have now caused US inflation expectations to nearly double, rising from ~2.7% to ~4.3% this year. The anticipated rate cuts in 2025 may not materialise if inflation continues climbing, which is not a great sign for risk-on assets.

Trump’s victory gave markets a pump, and now his tariffs are delivering the dump—or are they buying opportunities? The answer is both. The market is correcting due to the tariffs, but in doing so, it's presenting strong discounts across the board. From Bitcoin to altcoins, these pullbacks could yield significant gains for those who buy while the market is in extreme fear.

As Warren Buffett famously said, “Be greedy when others are fearful.” Right now, fear is at extreme levels, with the Fear & Greed Index at 10—its lowest reading since July 2022, when the Luna collapse sent Bitcoin below $20k. The key difference? Back then, Bitcoin was under $20k, and today it’s still above $80k—a strong sign of Bitcoin’s resilience and current strength.

Stormrake Spotlight: Sonic (S) ($0.72)

Despite closing red yesterday, Sonic (S) outperformed Bitcoin over the past 24 hours, declining at a slower rate. While S has now seen four consecutive red days, its bullish structure remains intact.

As long as S holds above the bottom of the highlighted bullish order block (OB), its bullish trend remains valid. Even if S retests this OB, strong buying demand within that zone should trigger a bounce.

Moreover, on-chain metrics for Sonic continue to outperform nearly every other blockchain, further strengthening its bullish case.

BTC/USD Key Levels and Price Action:

Bitcoin is extremely bearish on lower timeframes, with little support between current prices and the high $70k region. The lack of support is due to BTC’s rapid ascent in November, following Trump’s election victory.

For Bitcoin to reduce the risk of breaking its long-term bullish structure, it must hold key support levels. The first sign of recovery would be reclaiming $85.2k, which would revive bullish sentiment.

BTC Total ETF Flows for 26 Feb: $ -162.5 million

(ETF flow data is sourced from https://farside.co.uk/btc/ and reflects figures at the time of writing.)

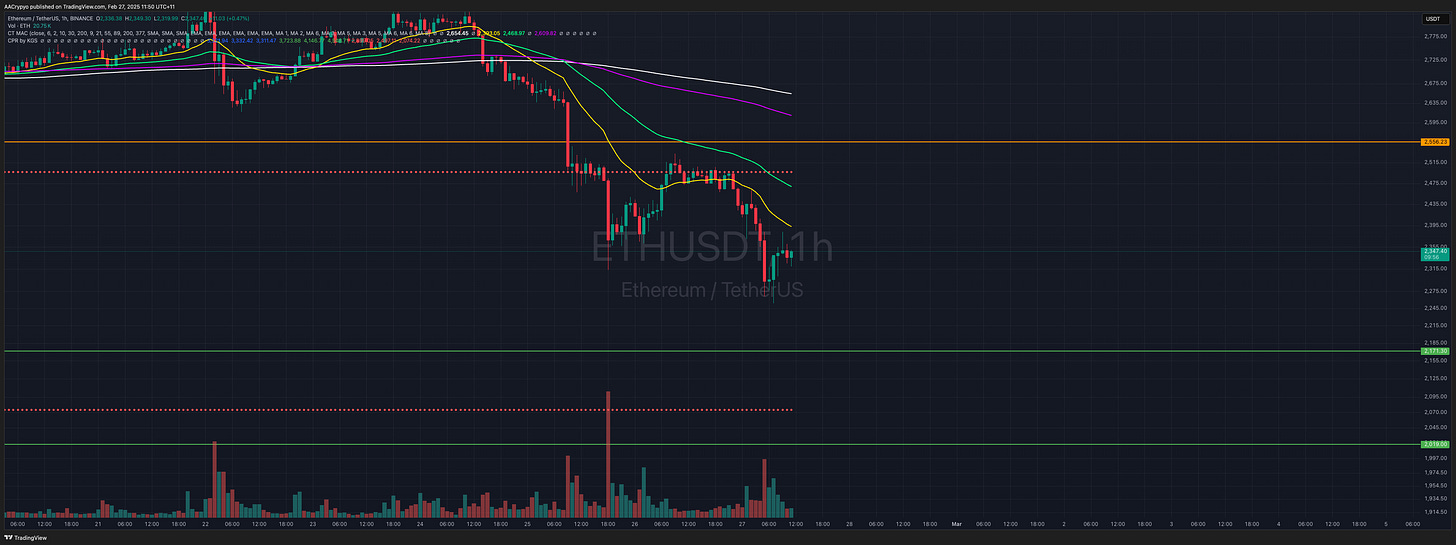

ETH/USD Key Levels and Price Action:

Ethereum’s attempt to reclaim the CPR level failed, as it was rejected at the confluence of that level and the 21EMA. Now trading lower, ETH looks set to retest key support at $2,171.

With bears in full control, ETH’s momentum and structure remain bearish. To regain bullish footing, BTC must first recover, as Ethereum’s movements remain closely tied to Bitcoin’s direction.

ETH Total ETF Flows for 26 Feb: $ -6.1 million

(ETF flow data is sourced from https://farside.co.uk/eth/ and reflects figures at the time of writing.)

*All prices are denominated in USD unless stated otherwise*

Written by Alexandar Artis

To view this article and many others on our blog - please click HERE

If you enjoyed this Morning Note, feel free to open an account and gain access to more proprietary research and work with your very own dedicated crypto broker.

Disclaimer

All statements made in this material are made in good faith and we believe they are accurate and reliable. Stormrake does not give any warranty as to the accuracy, reliability or completeness of information that is contained here, except insofar as any liability under statute cannot be excluded. Stormrake, its directors, employees and their representatives do not accept any liability for any error or omission in this newsletter or for any resulting loss or damage suffered by the recipient or any other person. Unless otherwise specified, copyright of information provided in this newsletter is owned by Stormrake. You may not alter or modify this information in any way, including the removal of this copyright notice.