Mexico & Canada Tariffs Set to Go Live—Markets React Bearishly

With new tariffs set to go live in a few days, market uncertainty remains high.

Trump continues to stand on business, and markets aren’t reacting well. The confirmation of tariffs going live—plus an additional 10% tariff on China—has only made things worse. With Canadian and Mexican tariffs set to go live on 4th March and China now facing a total 20% tariff.

And it’s not just Wall Street feeling the heat—US consumers are losing confidence fast. The latest data shows Consumer Confidence dropped 7 points in February, the biggest single-month decline since August 2021. That puts it at 98.3, dangerously close to its lowest level since 2022. On top of that, 67% of consumers now expect a recession within the next year—a 9-month high. The message is clear: people aren’t feeling great about the economy, and the uncertainty isn’t helping

All markets felt the effects of the overnight tariff confirmations, with Bitcoin dropping to a low of $82.6K before bouncing back. Meanwhile, the S&P 500 fell 1.59%, Gold slid 1.34%, and the VIX (volatility index) surged 10%, marking its 7th straight green day. Fear is rising across the board, with Bitcoin’s Fear & Greed Index sitting at 16—in extreme fear territory.

Bitcoin ETFs have now seen six consecutive days of outflows, totalling $2.1 billion, with a record-breaking $1 billion withdrawn in a single day on 25th February—the largest single-day outflow on record. This reflects the uncertainty within the market, as the lack of ‘stability’ is pushing retail investors to cash out and rotate into ‘safer’ assets like gold.

SEC Drops Lawsuit Against Coinbase & Memecoins Get a Free Pass

The SEC has dropped its lawsuit against Coinbase, signalling a major shift in regulatory tone—a development that could be bullish for the industry. That’s not all—memecoins also dodged a bullet, as the SEC ruled they aren’t securities, stating that 'Meme coins typically have limited or no use or functionality.' While this decision aligns with previous regulatory stances, it still marks a significant moment for the crypto space.

While that might sound like a backhanded compliment, it’s actually a big deal. If memecoins aren’t securities, it sets a precedent that could benefit the broader altcoin market.

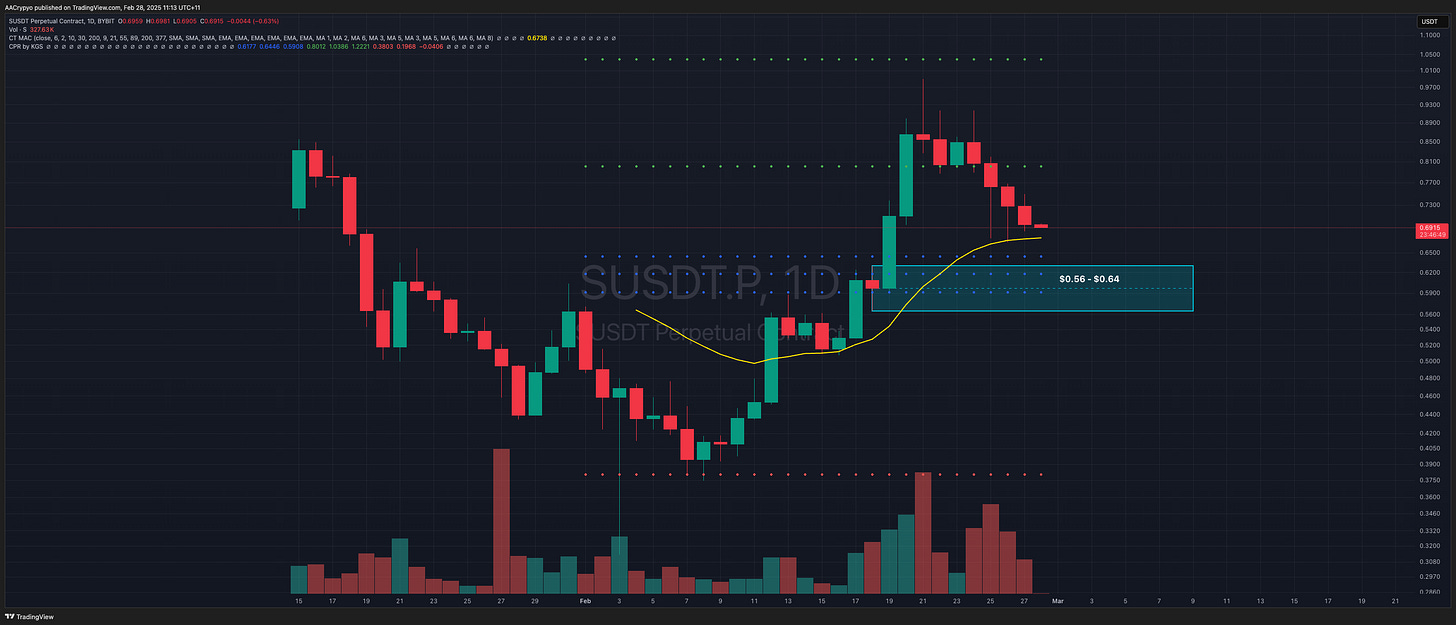

Stormrake Spotlight: Sonic (S) ($0.69)

Sonic has now closed its fourth consecutive red candle and is approaching the 21EMA, which has provided support multiple times already—first at $0.50 and more recently over the past few days. Each time, S has wicked down to this level before bouncing, showing that buyers are stepping in.

This should provide a strong support zone, making it a potential buy-the-dip opportunity. If Bitcoin holds its ground and doesn’t drop further, Sonic could find a base at this moving average, bounce, and maintain its bullish structure.

BTC/USD Key Levels and Price Action:

Bitcoin continues to struggle for momentum, with any bullish attempt quickly met with strong selling pressure—largely due to uncertainty surrounding tariffs. BTC briefly reclaimed the 21EMA overnight but failed to hold, falling back below it.

There is some bullish hopium, though—last night’s low created the first higher low. If BTC can break above both the 21EMA and 55EMA and push past $87.1K, the bullish structure will shift back in favour of the bulls.

BTC Total ETF Flows for 27 Feb: $ -20.0 million

(ETF flow data is sourced from https://farside.co.uk/btc/ and reflects figures at the time of writing.)

ETH/USD Key Levels and Price Action:

Ethereum continues to struggle after failing to break above the CPR level, forming lower highs and lower lows—not what any ETH holder wants to see. The 21EMA remains a major resistance and will continue to be a challenge until ETH can break above it.

For now, ETH seems likely to continue falling toward key support at $2,171 unless a significant reversal takes place.

ETH Total ETF Flows for 27 Feb: $ -19.6 million

(ETF flow data is sourced from https://farside.co.uk/eth/ and reflects figures at the time of writing.)

*All prices are denominated in USD unless stated otherwise*

Written by Alexandar Artis

To view this article and many others on our blog - please click HERE

If you enjoyed this Morning Note, feel free to open an account and gain access to more proprietary research and work with your very own dedicated crypto broker.

Disclaimer

All statements made in this material are made in good faith and we believe they are accurate and reliable. Stormrake does not give any warranty as to the accuracy, reliability or completeness of information that is contained here, except insofar as any liability under statute cannot be excluded. Stormrake, its directors, employees and their representatives do not accept any liability for any error or omission in this newsletter or for any resulting loss or damage suffered by the recipient or any other person. Unless otherwise specified, copyright of information provided in this newsletter is owned by Stormrake. You may not alter or modify this information in any way, including the removal of this copyright notice.