Metals Take the Spotlight, Bitcoin Bides Time

Bitcoin remains range-bound at $88K as investor attention shifts to silver’s explosive rally, with capital rotation likely once the metals run cools.

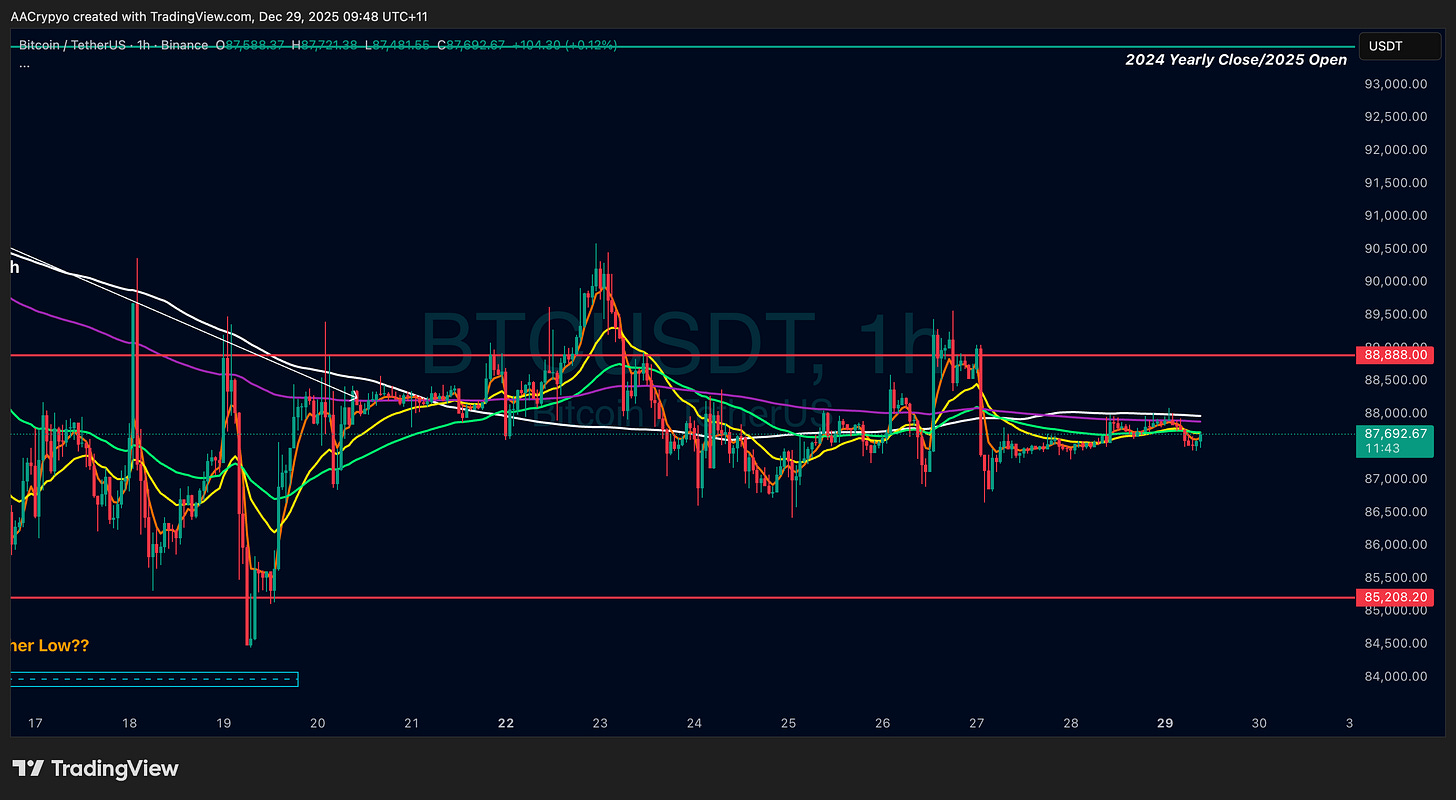

For much of December, Bitcoin has remained pinned around $88K, despite several macro events that would usually trigger some price action. Two major central banks made rate announcements, the US Federal Reserve cut rates while the Bank of Japan raised them. Mixed signals, yet Bitcoin stayed unfazed.

Last week, we highlighted that the final Bitcoin options expiry for the year was approaching, with a large cluster of strike prices set around $96K. Bulls were hoping for a late-month move higher to offset potential losses, but that did not happen. Bears were eyeing to drag price back down below $83K to $84K, the reported average entry range for Spot Bitcoin ETFs. That also failed. As expected, Bitcoin remained steady at $88K while attention shifted elsewhere.

Silver has been the standout performer of the year. With supply short for the fifth consecutive year and demand outpacing production, it has finally gone euphoric. Last week alone it gained nearly 20 %. With fewer participants due to the holiday period and historically lower volumes, silver has captured the bulk of risk-on attention.

Google search interest for “silver” has now hit an all-time high. It mirrors the moment earlier this year when people queued for hours to buy physical gold near its local top. Despite the euphoric sentiment, this does not necessarily mark the top for silver. Moves like this often lead to capital rotation back into Bitcoin once metals begin to cool off.

While Bitcoin has been flat throughout the month and may seem disconnected, traditional indices have not exactly surged either. The S&P 500 is only up 1 % in December. It is clear where capital has been flowing, commodities. We saw this earlier in the year, though the commodity rally then was not as aggressive. The rotation tends to follow a pattern, first into commodities, then into traditional risk assets, and finally into Bitcoin.

Stormrake Spotlight: Pax Gold (PAXG) ($4,562)

PAXG continues its strong run, now approaching $4,600 and printing new record closes. Momentum looks set to carry into the new year, with a potential move to $4,800 likely if current strength holds.

BTC/USD Key Levels and Price Action:

Since our last morning notes, Bitcoin has made little progress. It briefly attempted to break above $88,888 on the back of the options expiry last Friday, but failed to sustain the move. Price remains range-bound at $88K, with both structure and momentum looking neutral heading into January.

BTC Total ETF Flows for 28 Dec: (data not available at the time of writing)

(ETF flow data is sourced from https://farside.co.uk/btc/ and reflects figures at the time of writing.)

*All prices are denominated in USD unless stated otherwise*

Written by Alexandar Artis

To view this article and many others on our blog - please click HERE

If you enjoyed this Morning Note, feel free to open an account and gain access to more proprietary research and work with your very own dedicated crypto broker.

Disclaimer

All statements made in this material are made in good faith and we believe they are accurate and reliable. Stormrake does not give any warranty as to the accuracy, reliability or completeness of information that is contained here, except insofar as any liability under statute cannot be excluded. Stormrake, its directors, employees and their representatives do not accept any liability for any error or omission in this newsletter or for any resulting loss or damage suffered by the recipient or any other person. Unless otherwise specified, copyright of information provided in this newsletter is owned by Stormrake. You may not alter or modify this information in any way, including the removal of this copyright notice.