Maximum financial opportunity

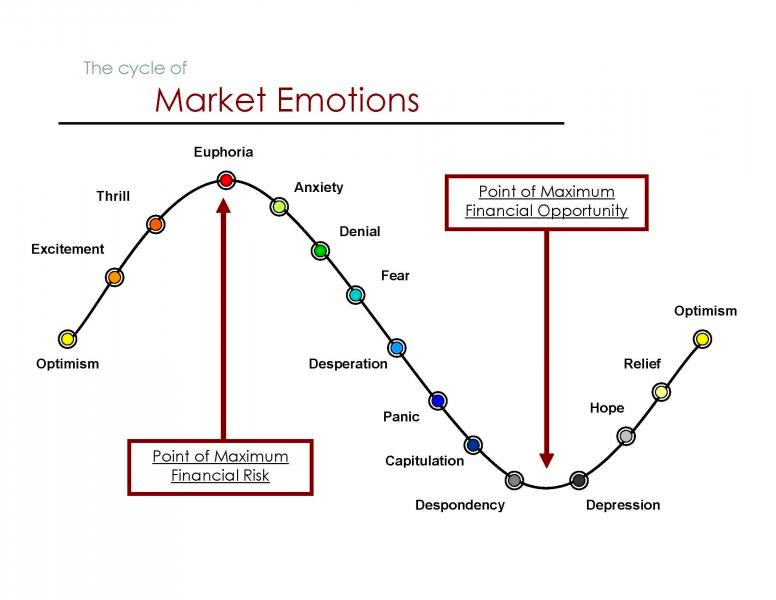

We have been discussing emotions and the importance of controlling them throughout market cycles, today let's discuss how this can impact your trading

The information contained here is for general information only. It should not be taken as constituting financial advice. Stormrake is not a financial adviser. You should consider seeking independent financial advice prior to making any personal investments.

Cycles are natural - accept them

I remember when Bitcoin first broke through previous market cycle high of 20k back in December 2020 and the sheer excitement and chatter on the trading desk as to how high are we going to run in this market cycle, there was a unilateral consensus bid and liquidity was being pumped into the financial markets at an astonishing rate.

The general feeling across the markets over the next 6 months was pure ecstasy, we all felt as if this was never going to end and then we had a monster correction that sent BTC tumbling from 65k —> 29k a 56% pop that put an end to the thrill and insane excitement the crypto markets were experiencing but we hadn’t hit peak euphoria yet.

Global financial markets decided to have one last hoorah and BTC shot from 30k to 70k, ETH nearly tripled, altcoins were putting in a 10x overnight, monkey jpegs were selling for over $500,000 and NFT trading volumes were mind melting.

This euphoria that we had all collectively experienced still gives traders a buzz just reminiscing on the good ‘ol days but all good things must come to an end. This came as the first half of 2022, provided a combination of head kicks and spinning elbows that floored investors the world over and capital destruction was pervasive causing widespread fear and panic to take over the markers.

Capitulation station

We have already covered the 3AC, Blockfi, Celsius and crypto credit collapse saga in Stormrake’s other publications ‘The Rake Review’ and ‘Thunder Trading Updates’, so we won’t cover the events that led to crypto capitulation in mid to late June 2022 but recent scars are still red raw and we’re only just starting to lift above the key 20k level on BTC. What is important to know is there was a ton of forced selling via liquidations of leveraged positions and monumental washout which led to a downward spiral in crypto asset prices.

What does this mean captain?

It means we are somewhere between despondency and depression, this is the EXACT ‘Point of Maximum Financial Opportunity’. This flies in the face of our human brain seeking patterns and extrapolating the current state well into the future with assumptions that because it’s bad now, it will remain so.

I’m not here to say that prices can’t head lower, they certainly can but it’s critical to note that these market cycles have existed for thousands of years and is built in by human fear and greed, we know the euphoria that we had experienced only 8 months ago and understand the complete despondency, we crypto investors felt only a few short weeks ago, so I ask you our reader to share your thoughts with us as to where we are in this market cycle and encourage you to draw your own conclusions.

Looking forward

Looking forward to the key levels present in the BTC market would be to watch a continuation towards 21.1k but the first line of support will be to watch 22.4k, should this hold a quick run up to 25k and with sufficient momentum a move to 27k couldn’t be ruled out. For downside risks, I will be watching for a daily close below 22k for a retest of the all too important 20k level.

Disclaimer

All statements made in this material are made in good faith and we believe they are accurate and reliable. Stormrake does not give any warranty as to the accuracy, reliability or completeness of information that is contained here, except insofar as any liability under statute cannot be excluded. Stormrake, its directors, employees and their representatives do not accept any liability for any error or omission in this newsletter or for any resulting loss or damage suffered by the recipient or any other person. Unless otherwise specified, copyright of information provided in this newsletter is owned by Stormrake. You may not alter or modify this information in any way, including the removal of this copyright notice.