Markets Rally Against the Odds as Inflation Heats Up

In a surprising turn, markets rally despite hotter-than-expected inflation data

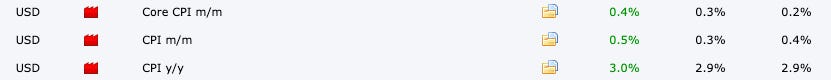

It was that time of the month again—when all eyes were on inflation data, with CPI readings being released. The forecasted numbers were a mixed bag: Core CPI was projected to increase, headline CPI was expected to decrease, and CPI YoY was anticipated to remain unchanged.

The actual data caught everyone off guard, with every key reading rising. Both core and headline CPI increased MoM, pushing YoY inflation higher as well. Core CPI MoM came in at 0.2%, beating the 0.1% projection, while headline CPI MoM unexpectedly rose by 0.1% instead of the anticipated 0.1% decline. As a result, headline CPI YoY climbed to 3%—up 0.1% rather than holding steady as expected. This is a step in the wrong direction for the U.S. Federal Reserve, which remains committed to its 2% inflation target.

With inflation rising, one would expect prices of risk-on assets to fall—and they did, initially. Within the first 15 minutes of the data release, Bitcoin dropped 2.5% to a low of $94k, with altcoins shedding over 4% in the same period. Traditional markets reacted similarly, as Nasdaq futures fell 1.26% on the news. When the Nasdaq and S&P 500 opened an hour later, they dropped 0.55% and 0.73%, respectively. However, that brief sell-off was all the bears could muster—a sharp 15-minute correction following what would usually be perceived as extremely bearish news.

From that low, Bitcoin has rebounded 4%, now trading higher than it was before the data release. The same can be said for most altcoins, with a sea of green across the board.

This inflation data signals a strengthening economy and now suggests we may only see one rate cut this year—perhaps two if we’re lucky—with the first anticipated in September.

January’s unexpectedly strong U.S. inflation reignited investor fears that a heating economy, combined with looming tariffs, could put the Federal Reserve in a tough position. Hopes for multiple rate cuts are fading. With consumer prices rising more than expected, the Fed is unlikely to rush into easing monetary policy, especially as economic uncertainty grows amid the expected inflationary impact of President Donald Trump’s tariffs on key trade partners.

Stormrake Spotlight: Ondo Finance (ONDO) ($1.40)

Ondo closed the day with a strong green candle, bouncing off the accumulation zone with a 5% gain. If it can reach $1.47, we’ll see a bullish cross of the 21 and 55 EMA, strengthening bullish momentum and potentially pushing ONDO higher toward the lower high of $1.64.

BTC/USD Key Levels and Price Action:

Another day, another failed attempt to break below the key support of $95.7k. Bitcoin has since rallied over 4% from this level, reclaiming all major moving averages in the process. With this newfound bullish momentum, BTC has a chance to flip structure back in favour of the bulls—if it can break above the previous high of $98.4k. A sustained breakout should see BTC retest $100k.

BTC Total ETF Flows for 12 Feb: $ - 113.5 million

(ETF flow data is sourced from https://farside.co.uk/btc/ and reflects figures at the time of writing.)

ETH/USD Key Levels and Price Action:

Ethereum has once again bounced off the key support of $2,556, finally breaking above all major moving averages and flipping both momentum and structure back to the bulls. With a higher low and higher high in place, ETH now looks primed to retest the key resistance level of $2,865.

ETH Total ETF Flows for 12 Feb: $ - 30.2 million

(ETF flow data is sourced from https://farside.co.uk/eth/ and reflects figures at the time of writing.)

*All prices are denominated in USD unless stated otherwise*

Written by Alexandar Artis

To view this article and many others on our blog - please click HERE

If you enjoyed this Morning Note, feel free to open an account and gain access to more proprietary research and work with your very own dedicated crypto broker.

Disclaimer

All statements made in this material are made in good faith and we believe they are accurate and reliable. Stormrake does not give any warranty as to the accuracy, reliability or completeness of information that is contained here, except insofar as any liability under statute cannot be excluded. Stormrake, its directors, employees and their representatives do not accept any liability for any error or omission in this newsletter or for any resulting loss or damage suffered by the recipient or any other person. Unless otherwise specified, copyright of information provided in this newsletter is owned by Stormrake. You may not alter or modify this information in any way, including the removal of this copyright notice.