The information contained here is for general information only. It should not be taken as constituting financial advice. Stormrake is not a financial adviser. You should consider seeking independent financial advice prior to making any personal investments.

When it rains, it pours

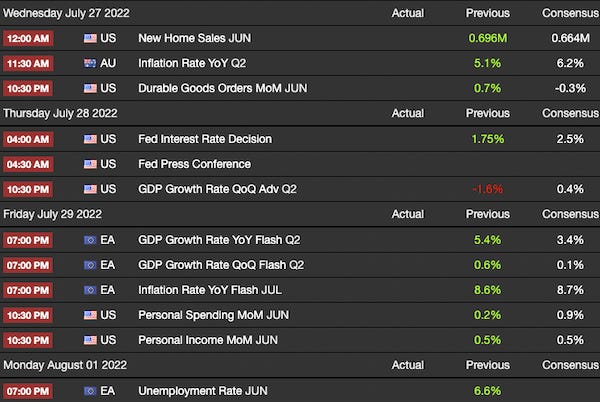

TradFi & crypto investors have a massive week ahead as markets will look to digest a potential 110 bps rise in Australian inflation, 50bps to 100bps rate hike coming out of the FOMC meeting and reduced growth coming out of both the EU and the US with slashed GDP forecasts.

Source: Trading Economics

Despite the grim macro outlook and the era of ‘easy money’ at least for now a distant chapter in investing history, we can’t rule out the possibility of a continuation of the bear market relief rally we’re currently witnessing.

To recap:

BTCUSD - up 20% from JUN 22 lows

ETHUSD - up 66% from JUN 22 lows

NDX - up 11.5% from JUN 22 lows

This shows that even in a hiking environment with very little accommodative monetary policy, investors suffering from a horrendous H1 in 2022 still have the appetite to bid risk assets when they present valuations far too attractive to pass up.

To the moon?

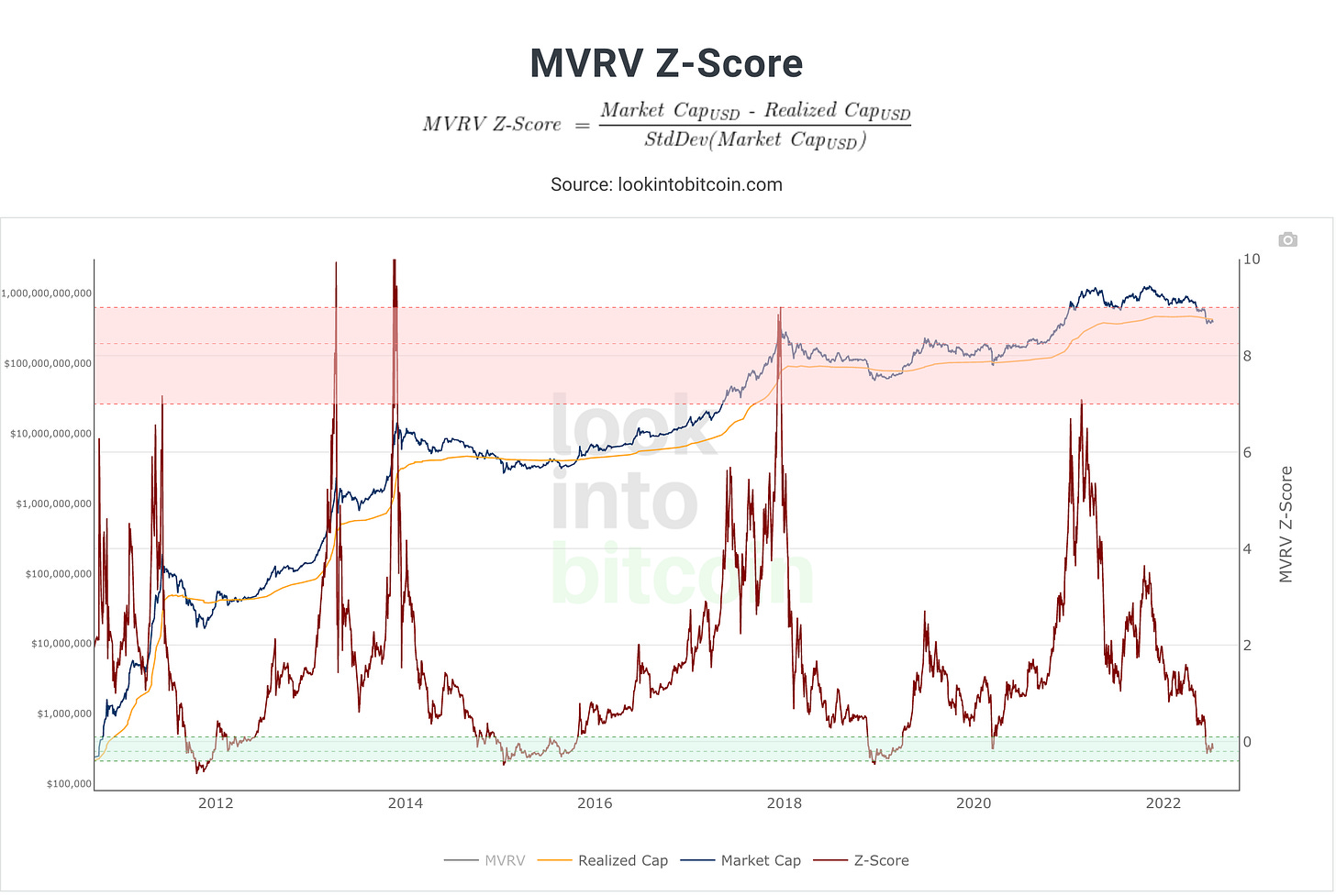

Although many indicators (shown below) are highlighting how attractive current levels are for accumulation, it’s still uncertain times ahead and we’re tired of the cliche as much as you are but if it’s one thing markets hate, it’s uncertainty and this could easily cause another sell off as investors hit “risk-off” sentiment once again.

Source: Look Into Bitcoin

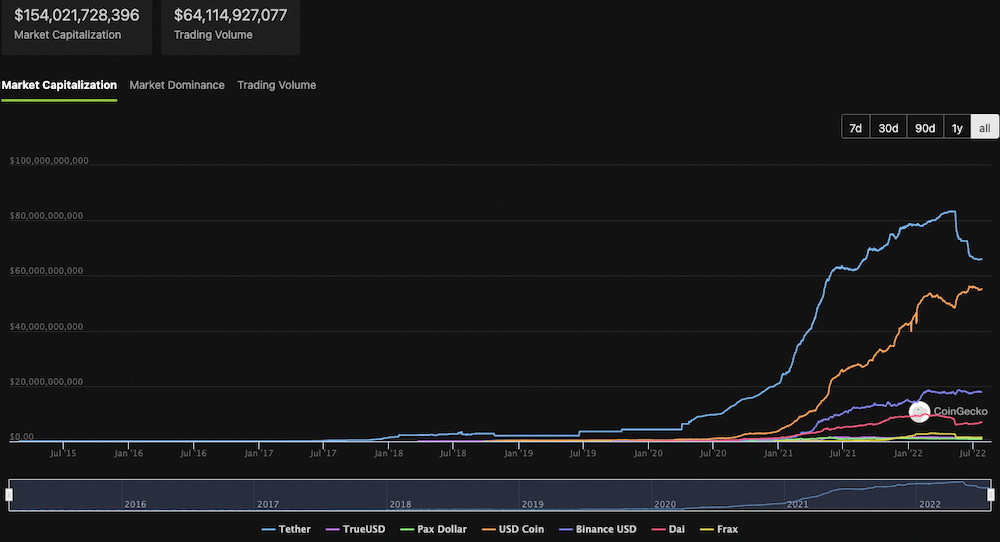

Total stablecoin market cap has risen throughout the crypto bear market of 2022 and can easily continue to rise as new stablecoins are minted as capital flows into the asset class and as a pro cyclical force tends to be a leading indicator for inflows into digital assets such as Bitcoin and Ethereum

Source: Coingecko

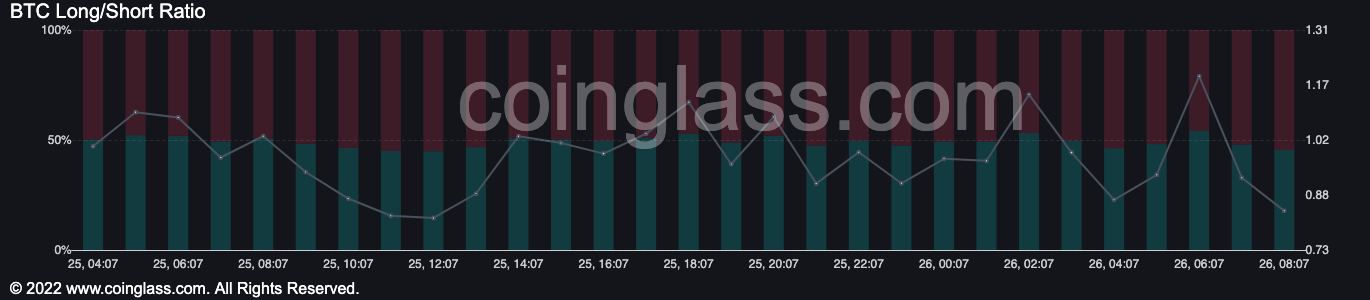

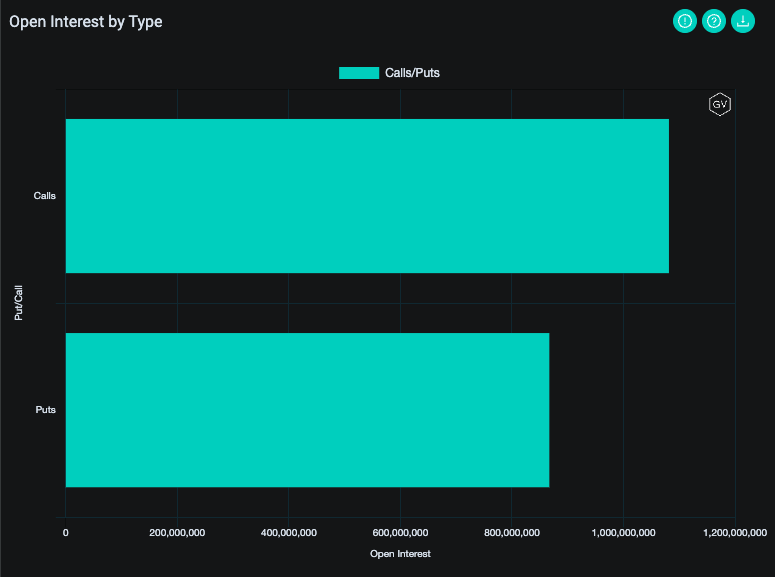

Heading into a large macro driven week it will be important to monitor the derivatives market and get a gauge of trader sentiment and positioning.

We can see in the last 12 hours short open interest starting to climb across exchanges but the options market has a slightly different view, with 1.6 billion dollars worth of option set to expire on the 29th July with a skew favouring call options, highlighting options traders expecting a lift in prices towards the end of the week.

Swings & Roundabouts

The general sentiment in the market is that there will be a move to the downside heading into the FOMC meeting with a likely retest of the key 20k BTCUSD level, should this provide the support we need and we get a strong daily close above this level then a move back up to 28k will be the next big battle to witness.

We also have to respect the wide ascending channel that BTC is currently trading in and expect that the 28k retest will be full of swing highs and lows retesting the upper and lower channels.

Disclaimer

All statements made in this material are made in good faith and we believe they are accurate and reliable. Stormrake does not give any warranty as to the accuracy, reliability or completeness of information that is contained here, except insofar as any liability under statute cannot be excluded. Stormrake, its directors, employees and their representatives do not accept any liability for any error or omission in this newsletter or for any resulting loss or damage suffered by the recipient or any other person. Unless otherwise specified, copyright of information provided in this newsletter is owned by Stormrake. You may not alter or modify this information in any way, including the removal of this copyright notice.