J Pow brings the hammer down

In our previous Morning Note, Jackson Hole is the Super Bowl of Macro, we had warned that the syndicate of central bankers can cause a lot of pain to the markets and they unfortunately delivered

The information contained here is for general information only. It should not be taken as constituting financial advice. Stormrake is not a financial adviser. You should consider seeking independent financial advice prior to making any personal investments.

There will be blood

‘‘We will keep at it until we are confident the job (i.e. killing inflation) is done.’’

Jerome Powell, Jackson Hole speech

The Federal Reserve chairman was on a mission to cool market expectations following his last speech. His last public appearance had him mention that the FED had reached its desired “neutral rate” this caused the market to assume a “FED pivot” is coming and that the liquidity tap is going to be turned on again. Unfortunately, this caused a mismatch in market expectations especially for risk assets. What we had seen in traditional markets on Friday and for crypto throughout the weekend was a snap back to reality.

Let’s evaluate the impact by looking at the charts and seeing what key levels are currently getting stress tested.

ETH/BTC key levels

The merge narrative has taken bit of a back seat as the wider macro picture looms ominously over the crypto markets. This has caused our resistance level of 0.08 to solidify and was the exact turning point for the ETH/BTC sell-off. The next key level to watch will be 0.064 which can be retested heading into the merge itself before breaking up higher. Should this level fail to hold the next key levels of support comes in at 0.055 and 0.049 respectively.

Bearish price action can quickly become invalidated if the market rallies and closes above the 0.08 level where the next major resistance comes in at 0.088. We will be attending the ETH dev meeting live calls and be providing key updates as they happen.

BTC/USD key levels

Bitcoin currently just trades under the all too important 20k key level, a failure to reclaim and hold this level will send us towards a retest of 18.9k. This sharp sell off can cause a bounce as it comes into the fib retracement channel and we could enter a rangebound market between 18.9k and 20k. Failing to hold here will have a retest of the local lows coming in at 17.6k. In the event a 20k reclaim does happen, watch for a slow grinding move back to 22.7k.

ETH/USD key levels

Ethereum is currently flirting with its critical support of $1,422 USD putting it in a similar predicament as Bitcoin, where if this level is lost it can get teleported to $1,241 quite quickly, this can cause the bulls to lose their foothold and see a retest of the $1k zone.

Inversely, if we can hold at 1422 and put on a strong base, it sets up for a move back towards 1700 where it retraces the Friday sell-off.

Macro watch

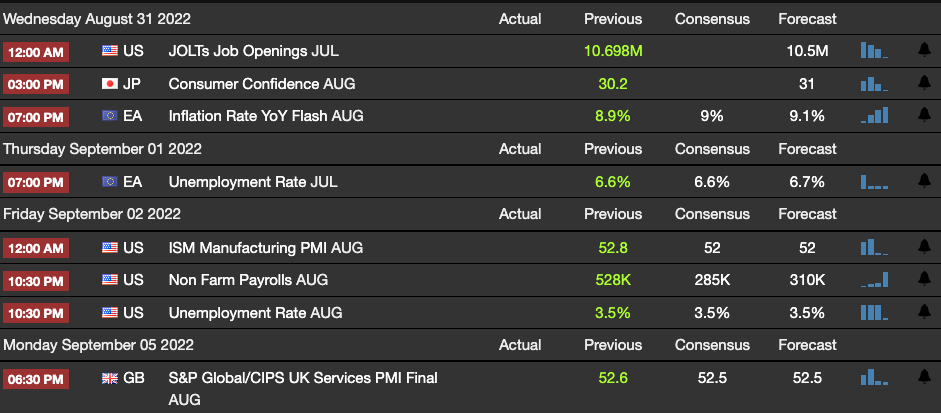

There are a few key events that will occur this week that will cause a lot of volatility, especially considering how sensitive asset prices are towards the macro environment.

The ones to watch will be the following:

Euro-zone inflation set to come out on Wednesday 7pm AEST

US employment data set to come out on Friday 10:30pm AEST

A higher than expected inflation print coming out of the EU and a tight labour market in the US will be a double punch in the guts for risk assets. This is due to central bankers around the world wanting to keep facades on fighting inflation, couple this with strong employment and they have a clear runway to continue hiking rates.

On a quick side note, it’s pretty alarming that unelected bureaucrats can plan to hike interest rates in hopes of crushing employment to cool inflation.

Not much else is on the radar, this gives us battle weary crypto investors a bit of a break before heading back into the trenches for what should be a glorious September.

Disclaimer

All statements made in this material are made in good faith and we believe they are accurate and reliable. Stormrake does not give any warranty as to the accuracy, reliability or completeness of information that is contained here, except insofar as any liability under statute cannot be excluded. Stormrake, its directors, employees and their representatives do not accept any liability for any error or omission in this newsletter or for any resulting loss or damage suffered by the recipient or any other person. Unless otherwise specified, copyright of information provided in this newsletter is owned by Stormrake. You may not alter or modify this information in any way, including the removal of this copyright notice.