Is It Over?

Market volatility remains high; most altcoins have rebounded, while Bitcoin struggles below $90K.

We’ve just seen the first Bitcoin daily close below $90K since mid-November. It must be over, right? We’ve broken below the wide consolidation range of $90K–$110K, altcoins were bleeding, Ethereum hit a low of $2,300, Solana dropped to $131, and the majority of altcoins tumbled, with some down more than 10% at intraday lows.

But these massive dips were opportunities. Those who stayed active and had the conviction to buy the dip and dollar-cost average are already beginning to reap the rewards.

This morning, the story was entirely different. Turn to the bubbles below, and you’ll see a sea of green.

Is this what “it’s over” looks like? With the majority of altcoins closing the day positive? If that’s the case, I’ll happily take it.

Keep in mind that bull market corrections happen. Bitcoin is currently down 20% from its all-time high in January, and altcoins have retraced even more. Yes, things look bearish, but no, it’s not over. “When in doubt, zoom out.” The short to medium term is bearish after breaking below a multi month consolidation range, but in the longer term, Bitcoin remains extremely bullish. From a technical standpoint, Bitcoin would still maintain its bullish structure even if it dropped to $76K and found a low there. While that wouldn’t be ideal, it wouldn’t break the market’s broader uptrend either.

These corrections should be seen as golden opportunities to accumulate more Bitcoin and dollar-cost average into your favourite altcoins.

Stormrake Spotlight: Sonic (S) ($0.74)

Sonic was one of the few altcoins that fell over the past 24 hours, losing 5.50% on the day and hitting an intraday low of $0.67. Now bouncing back to $0.74, Sonic has been one of the leading blockchains since its migration, and price action is finally reflecting that. With strong developer and investor interest, Sonic remains extremely undervalued and could be a solid pickup at these lower prices for those willing to take on some risk.

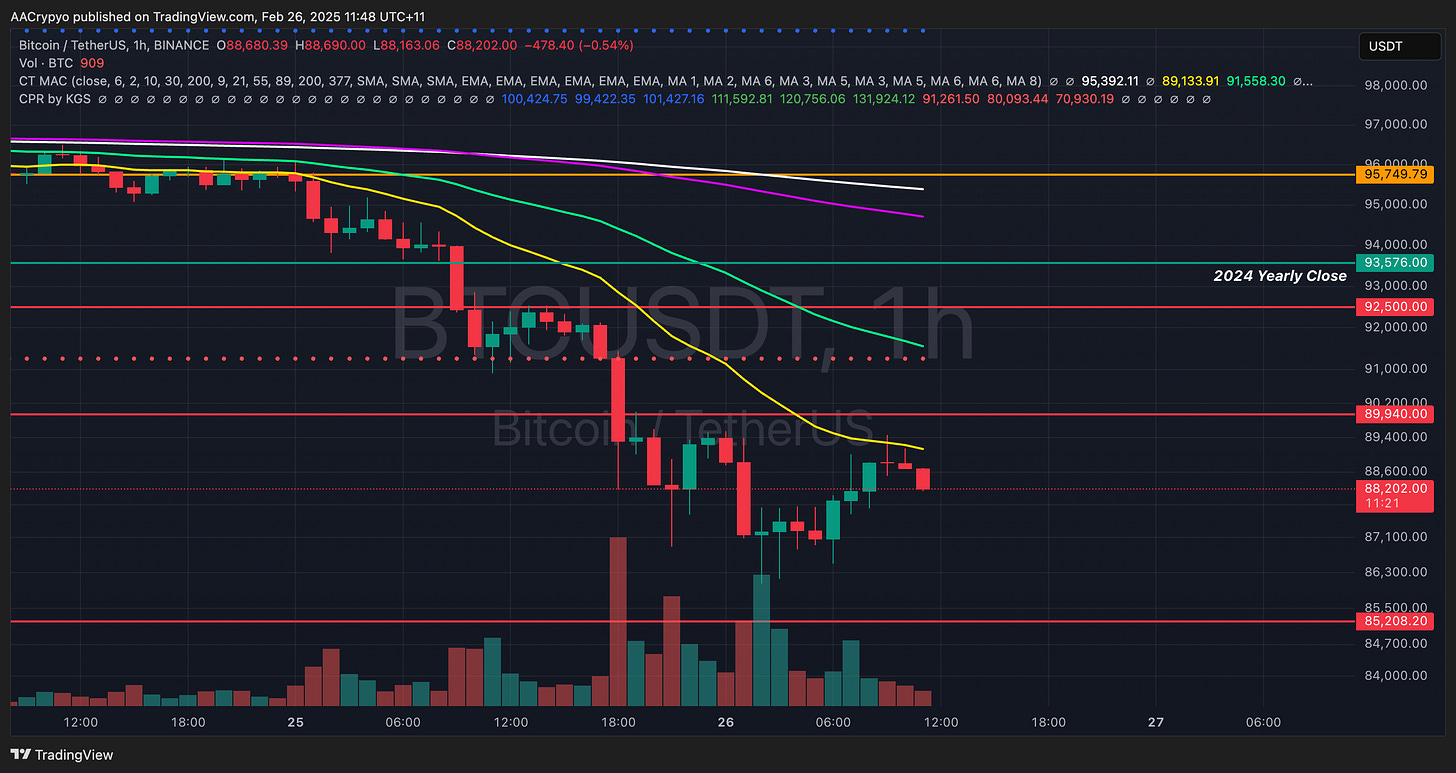

BTC/USD Key Levels and Price Action:

Bitcoin has dropped below several key levels over the last 24 hours and is likely to trade down to $85.2K. The 21 EMA has acted—and will continue to act—as resistance to any BTC bounces. The structure and momentum remain bearish, and the first sign of bulls regaining control would be BTC reclaiming $90K.

BTC Total ETF Flows for 25 Feb: $ -341.6 million

(ETF flow data is sourced from https://farside.co.uk/btc/ and reflects figures at the time of writing.)

ETH/USD Key Levels and Price Action:

Ethereum is also in a bearish structure with bearish momentum, though surprisingly, it has outperformed BTC over the last 24 hours. ETH is currently attempting to break the key level of $2,556 and the CPR level. It’s also trying to flip momentum back to the bulls, having just reclaimed the 21 EMA.

If ETH fails to break back above this level, we may see a retrace down to yesterday’s intraday low of $2,300.

ETH Total ETF Flows for 25 Feb: $ -37.6 million

(ETF flow data is sourced from https://farside.co.uk/eth/ and reflects figures at the time of writing.)

*All prices are denominated in USD unless stated otherwise*

Written by Alexandar Artis

To view this article and many others on our blog - please click HERE

If you enjoyed this Morning Note, feel free to open an account and gain access to more proprietary research and work with your very own dedicated crypto broker.

Disclaimer

All statements made in this material are made in good faith and we believe they are accurate and reliable. Stormrake does not give any warranty as to the accuracy, reliability or completeness of information that is contained here, except insofar as any liability under statute cannot be excluded. Stormrake, its directors, employees and their representatives do not accept any liability for any error or omission in this newsletter or for any resulting loss or damage suffered by the recipient or any other person. Unless otherwise specified, copyright of information provided in this newsletter is owned by Stormrake. You may not alter or modify this information in any way, including the removal of this copyright notice.