FTX Repayments Begin – But the Market Reacts Bearishly

Markets have reacted negatively to the start of FTX repayments.

The long-awaited FTX repayments have begun. While many investors believed this would inject fresh capital into the crypto market—potentially sparking an altseason or aiding a bullish breakout—it has instead had the opposite effect.

The controversy surrounding the repayments has left Bitcoin and Solana investors frustrated, as creditors received fiat USD rather than their original crypto holdings, valued at November 2022 prices. At that time, Bitcoin was priced at $20K and Solana at $15, compared to today’s prices of $95K and $165, respectively. The stark contrast has fueled negative sentiment, as creditors, rather than re-entering the crypto space, have chosen to cash out, triggering a market downturn.

This outcome was widely expected, as FTX has been transparent about its valuation approach. However, the harsh reality of these repayments has led to selling pressure rather than market reinvestment. This is only the first phase of repayments, with the next round set for May. If the trend continues, it could make for a turbulent year ahead.

Solana Faces the Biggest Hit

Solana has been the hardest-hit major asset so far. While creditors are receiving fiat USD instead of their original crypto holdings, the sell-off has still impacted SOL heavily. On top of that, last weekend’s memecoin meltdown drove many traders out of Solana-based projects entirely, adding further downward pressure.

Adding further pressure, a major Solana token unlock worth over $2 billion is set to take place on 1st March, further dampening sentiment around the 6th largest cryptocurrency.

Market Sentiment: Bearish and Toxic

Bitcoin and Ethereum have fared better than Solana in the past 24 hours. At the time of writing:

Bitcoin (BTC) is down 0.33%,

Ethereum (ETH) is down 2.87%,

Solana (SOL) has fallen 5.06%.

Sentiment across social media remains overwhelmingly negative—some have even suggested it feels "worse than the LUNA and FTX collapses in 2022." While that may be an exaggeration, given today’s much higher crypto prices, the bearish mood is undeniable.

This is why we continue to advocate for a dominant long-term Bitcoin position. Those who have accumulated Bitcoin are now witnessing near $100K BTC, while altcoin-heavy portfolios are struggling. Time and time again, Bitcoin proves its strength—use this period of consolidation to learn, adapt, and accumulate.

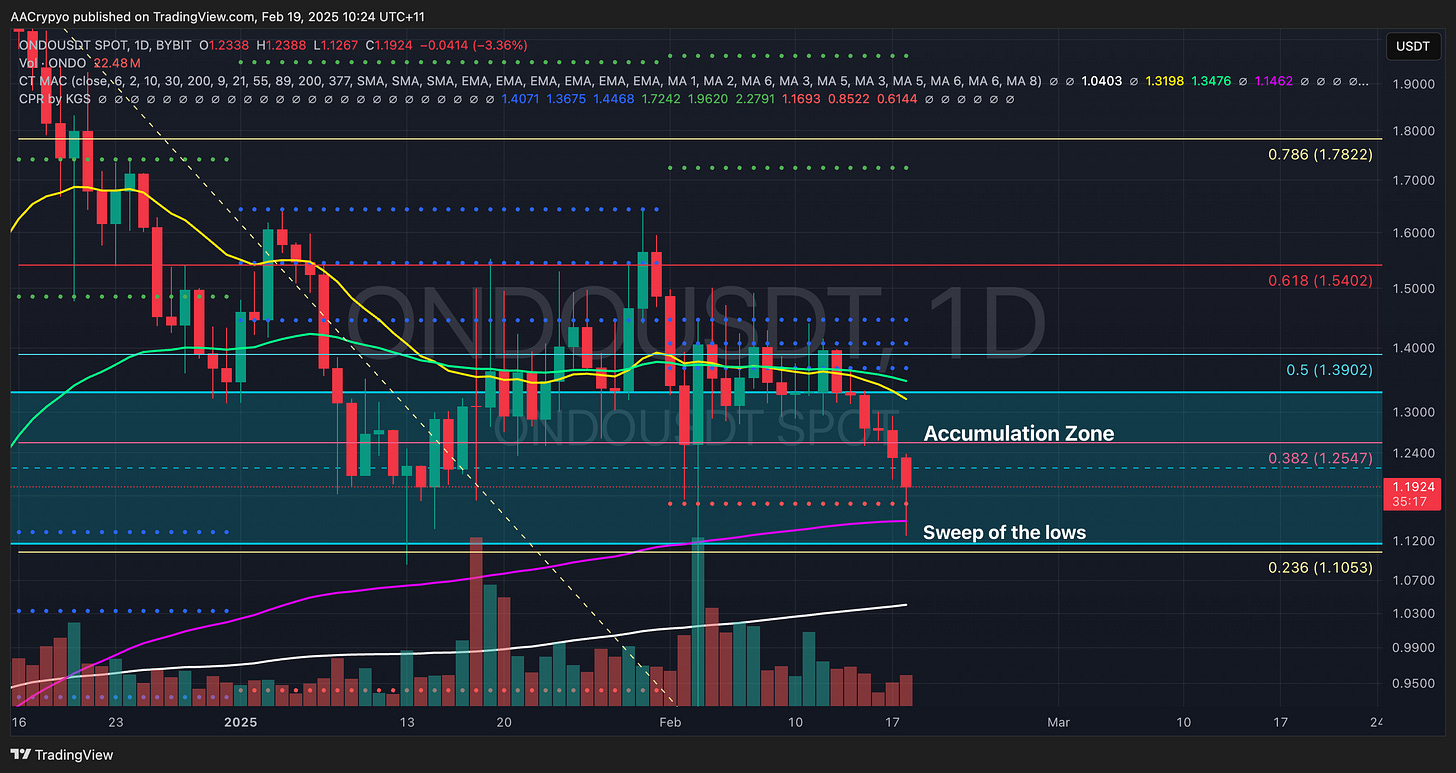

Stormrake Spotlight: Ondo Finance (ONDO) ($1.19)

As expected, Bitcoin’s dip dragged Ondo (ONDO) lower. However, Ondo has bounced impressively from its intraday low of $1.12, now up 6%. The price rebounded off key levels highlighted in previous analyses—the 200 EMA and monthly CPR support—indicating strong buying interest at the lower end of the accumulation zone.

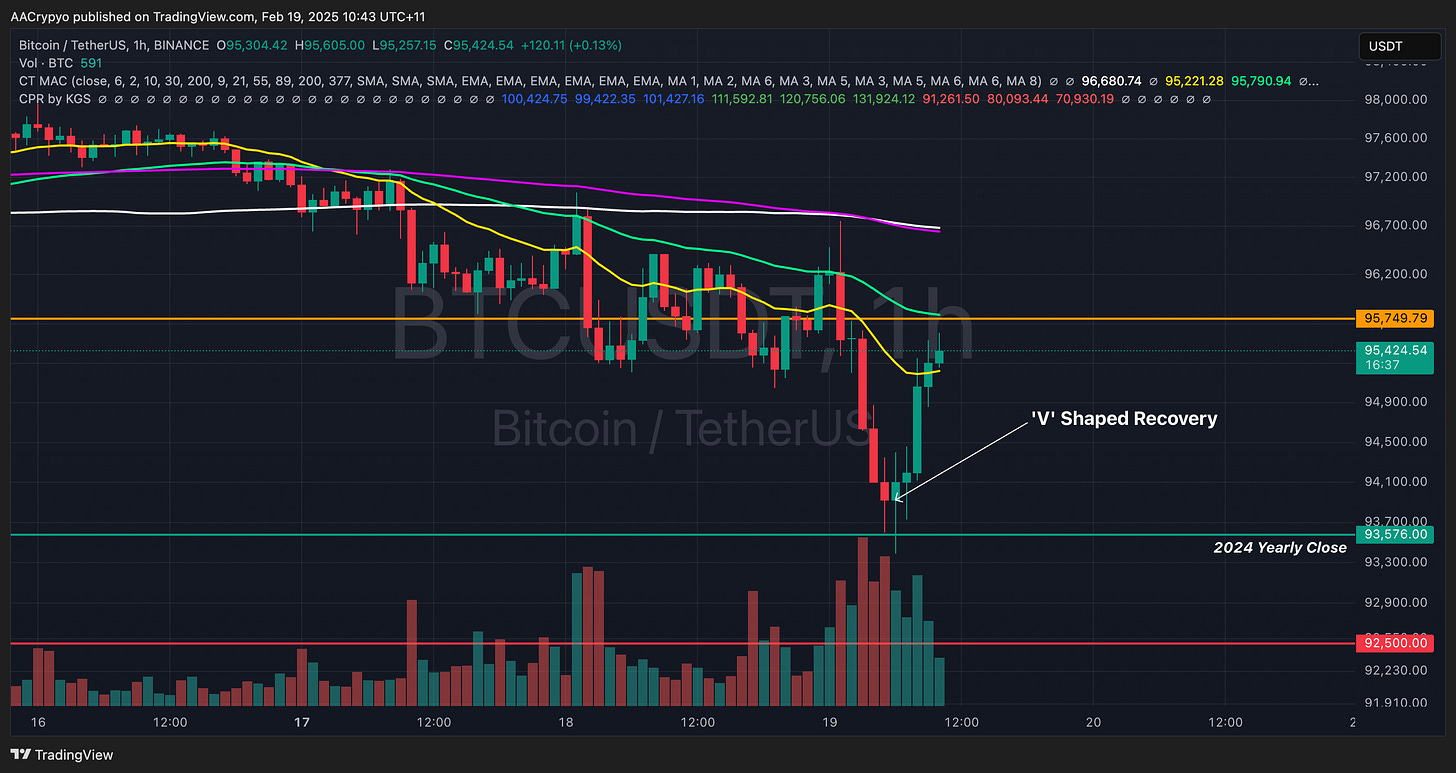

BTC/USD Key Levels and Price Action:

Bitcoin recently broke below key support at $95.7K, reaching a low of $93.5K—a level that aligns with the 2024 yearly close, acting as a strong support zone. This level triggered a V-shaped recovery, with BTC now up $2K from the low.

A reclaim of $95.7K would neutralise the bearish momentum, bringing Bitcoin back into consolidation territory.

BTC Total ETF Flows for 18 Feb: $ -112.7 million

(ETF flow data is sourced from https://farside.co.uk/btc/ and reflects figures at the time of writing.)

ETH/USD Key Levels and Price Action:

Ethereum has mirrored Bitcoin’s price action, forming a V-shaped recovery from an intraday low of $2,605. ETH is now facing converging moving averages between $2,671 and $2,700. A break above this range could clear the path for a retest of the range highs.

ETH Total ETF Flows for 18 Feb: $ (Data not available at the time of writing).

(ETF flow data is sourced from https://farside.co.uk/eth/ and reflects figures at the time of writing.)

*All prices are denominated in USD unless stated otherwise*

Written by Alexandar Artis

To view this article and many others on our blog - please click HERE

If you enjoyed this Morning Note, feel free to open an account and gain access to more proprietary research and work with your very own dedicated crypto broker.

Disclaimer

All statements made in this material are made in good faith and we believe they are accurate and reliable. Stormrake does not give any warranty as to the accuracy, reliability or completeness of information that is contained here, except insofar as any liability under statute cannot be excluded. Stormrake, its directors, employees and their representatives do not accept any liability for any error or omission in this newsletter or for any resulting loss or damage suffered by the recipient or any other person. Unless otherwise specified, copyright of information provided in this newsletter is owned by Stormrake. You may not alter or modify this information in any way, including the removal of this copyright notice.