Financial Privacy Denied Access

To say there has been a lot of news to digest over the last 24 hours would be an understatement and we'll be doing a quick surface level dive to assess the impact on the crypto market

The information contained here is for general information only. It should not be taken as constituting financial advice. Stormrake is not a financial adviser. You should consider seeking independent financial advice prior to making any personal investments.

Tornado Cash added to US sanctions list

$437m of assets have now been sanctioned by the Office of Foreign Assets Control (OFAC). These assets have resided on or interacted with the Tornado Cash protocol.

Let’s first understand what the protocol does. Tornado Cash is a mixer, a protocol designed to pool funds in an effort to obfuscate the origin of any given transaction.

Secondly, let’s examine what OFAC does, they administer and enforce sanctions against high profile individuals including major international terrorists, drug trafficking kingpins, and the financial/political elite of certain countries deemed hostile to American interests.

Thirdly, let’s try to assess the impact this will have on the crypto market. To be clear, Tornado Cash is not a service, it is open source software and its purpose is financial privacy, and not "money laundering" as many are claiming. Whilst the protocol does have bad actors using the protocol, this doesn’t mean the entire user base are doing the wrong thing. Consider a bank that has serviced money laundering and terror financing, they may face fines and the individuals or nation states using the bank will be sanctioned further but a legitimate user of the same bank in Iowa won’t face these sanctions. However legitimate users of Tornado cash are being sanctioned via the Tornado Cash contract address.

Ethics and freedom aside, this action by OFAC will most likely galvanise the cryptography ethos and further highlight the importance of financial privacy. Although the short term impact is fear, uncertainty and doubt, the medium to long term impact will be the wider crypto community coming together and building private, secure and decentralsied dApps, protocols, L2s, side-chains and blockchains.

Even now there has been a massive spike in Tornado Cash activity and although these sanctions only restrict US citizens and corporations, the implications for global politics and general users are yet to be fully understood.

The dangers of centralisation

Infura is a Web3 backend and Infrastructure-as-a-Service (IaaS) provider that offers a range of services and tools for blockchain developers. They also operate as the default node setting for popular web3 wallets such as MetaMask. The issue here is Infura are now blocking RPC requests to Tornado Cash

Centralised RPC services are the achilles heel of web3 ethos as it undermine the core benefits of crypto. As long as they dominate the market, no protocol is truly permissionless.

The frog in boiling water

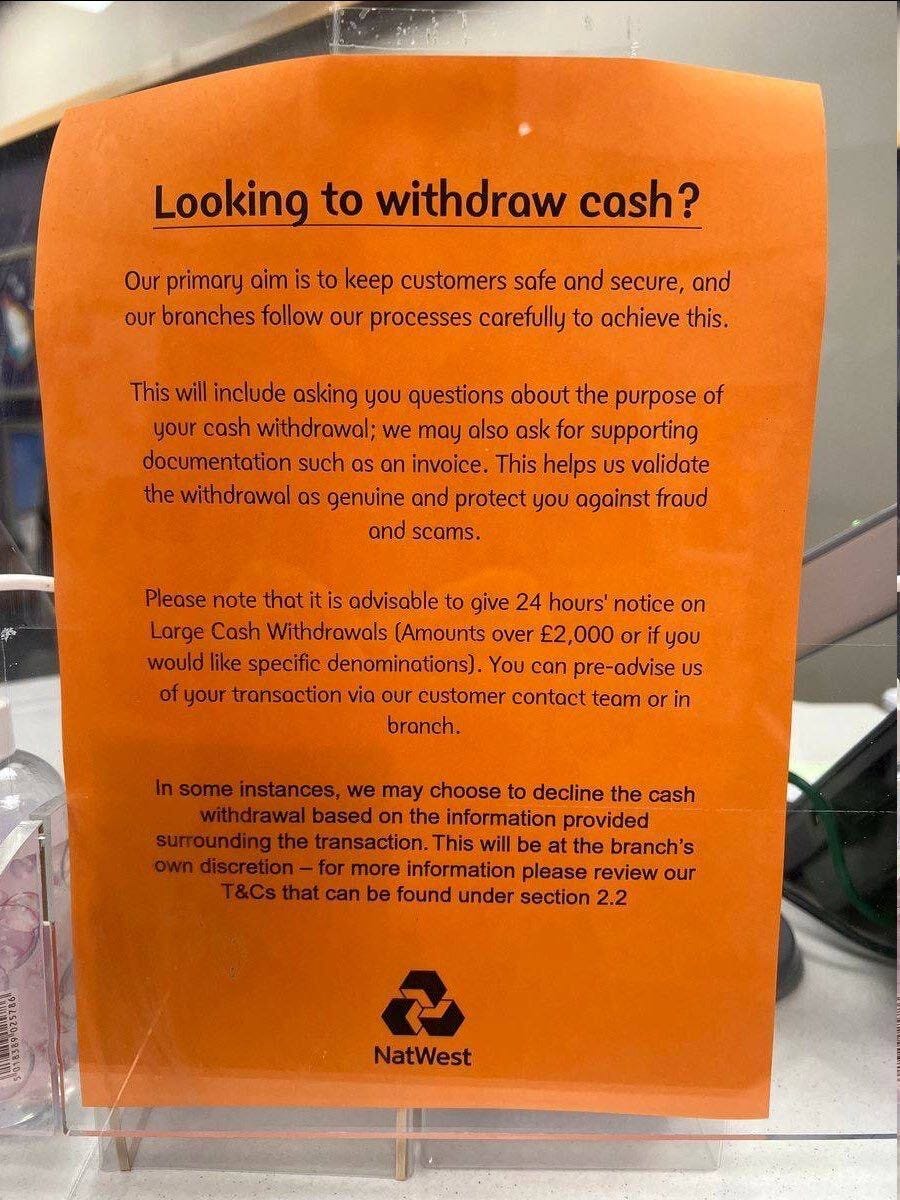

This issue of centralised financial infrastructure and administrators dictating how their users can access, use and withdraw their funds is not just an issue limited to crypto but also seen here in bricks and mortar banks. The image above was from a Bank in Britain highlighting how tenuous the relationship between “your money” and the bank that controls and permissions access to your funds.

This reminds me of the fable of the frog brought to boil, that when placed in normal water and the heat is only ever so slightly brought up over time, the frog won’t leap out of the pot but instead boil to death. It’s concerning that the everyday person is the frog and doesn’t realise the slight changes occurring around them that degrades their financial freedom. Despite all of its shortfalls and clear issues, cryptocurrencies may be one of the last bastions of financial and economic liberty but the issues highlighted above will be a true battleground for cypherpunks.

Disclaimer

All statements made in this material are made in good faith and we believe they are accurate and reliable. Stormrake does not give any warranty as to the accuracy, reliability or completeness of information that is contained here, except insofar as any liability under statute cannot be excluded. Stormrake, its directors, employees and their representatives do not accept any liability for any error or omission in this newsletter or for any resulting loss or damage suffered by the recipient or any other person. Unless otherwise specified, copyright of information provided in this newsletter is owned by Stormrake. You may not alter or modify this information in any way, including the removal of this copyright notice.