Fear the cornered bull

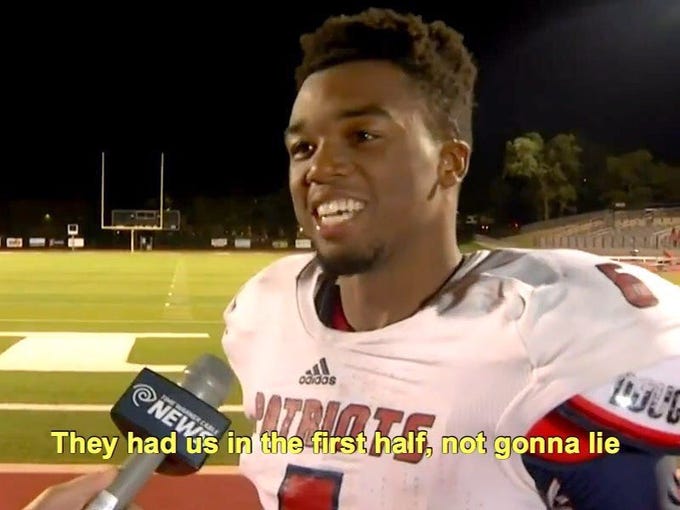

With macro conditions about as grim as they can get and many expecting markets to further suffer, the markets have simply shrugged and decided 'well can't get much worse, might as well start bidding'

There is an old market saying, ‘bear market rallies run harder and for longer than you can always anticipate’. We’re now seeing the start of a ‘hated rally’ as many investors, traders and macro analysts were calling for more doom, risk assets mainly crypto and equities have risen like a mighty phoenix from the ashes of the worst first half in a calendar year in over 50 years.

Half-time Review

Let’s recap some of the vicious drawdowns across global markets to put into context the savagery of the sell-off and hopefully provide some colour to what H2 may have in store for us.

Jan 1st 2022 - July 1st 2022 drawdowns:

BTC: -63%

ETH: -77%

BNB: -65%

SPX: -24%

NDX: -33%

US10Y: -12%

As we can tell the first half provided no relief and no shelter for the entrapped investor as not even bonds provided safe harbour and with red hot CPI inflation prints coming in across the globe, interest rate hikes being fired out and a technical recession being confirmed with two straight negative quarters of growth coming out of the US, you wouldn’t be wrong to assume that the second half would be just as horrendous but instead we have had some astonishing rallies.

The simple reason for this rally if we were to really boil it down came off the back of this exchange with Federal Reserve Chair, Jerome Powell:

Journalist: ‘‘Mr. Powell, due to the recent bond and equity market rally financial conditions have eased quite a lot: what’s your take?’’

Powell: ‘‘The appropriate level of financial conditions will be reflected in the economy with a lag and it’s hard to predict. We will be fully data dependent’’

This essentially puts forward guidance headfirst into a wood-chipper and means that the markets are free to interpret the inflation fight and future rate raises. Without this further guidance from the FED as an anchor for expectations, we’re now seeing the bond, equity and crypto markets discounting worse expectations in the future.

Captain, land ahoy!

We’re now finally on steady land and out of volatile uncharted waters. This doesn’t mean asset prices won’t take a beating, as the land our ship has found safe harbour in, is an unmarked island in the middle of the Pacific Ocean. For now we’re on the beach and the sun is shining. In this analogy, global traders and investors are the crew that have found some respite after 6 months at sea with nothing but uncertainty and although we’re not in the clear yet, we can enjoy this little island for what it is before intrepid investors set sail again and aim to find positive portfolio returns.

Expectations tempering

The rational trader would be wise to anticipate some sort of pullback after such a strong rally where BTC has climbed over 35% off the lows. Using previous swing low ranges on the H4 chart we could see a retest of 21.1k before running to the upper end of the existing channel coming in at 25.9k.