Endless Consolidation: Bitcoin’s Stalemate Continues

Bitcoin remains stuck in a tight range despite events that would typically drive a breakout.

For what seems like an eternity, Bitcoin continues to trade within a tight 4% range—but in reality, it has only been 13 days. Since February 4, we haven’t seen Bitcoin close a daily candle outside the $95.7K–$100K range. In crypto land, 13 days can feel like forever.

Why Has Bitcoin Been Stuck?

Despite a slew of major events, Bitcoin has remained in this narrow band. Over the past two weeks, we’ve seen tariff and trade war developments, Bitcoin Czar David Sacks speak, CPI data releases, Fed Chair Jerome Powell’s commentary, and more memecoin antics. Yet, none of these catalysts have been able to push Bitcoin meaningfully in either direction.

So, what’s keeping Bitcoin in this tight range?

Market Uncertainty:

Sentiment remains neutral, which is reflected in Bitcoin’s price action and overall market indecision. The Fear & Greed Index currently sits at 51—almost perfectly neutral. Just last week, it was in the fear zone at 43, a sharp drop from its greedy reading of 72 on February 4.

Memecoins Are Stealing Liquidity…

The past few days have seen major trading volume shift toward memecoins. The BNB chain’s integration of memecoins, driven by CZ’s involvement, saw a surge of capital into the Binance ecosystem. However, LIBRA, one of the biggest rug pulls in history, wiped out over $6 billion from the memecoin market (read yesterday’s Morning Note for more details).

Memecoins may seem like harmless, high-risk gambles, but the reality is 99% of buyers will lose money—damaging confidence in crypto and driving people away from the space altogether.

Traditional Buying Has Slowed

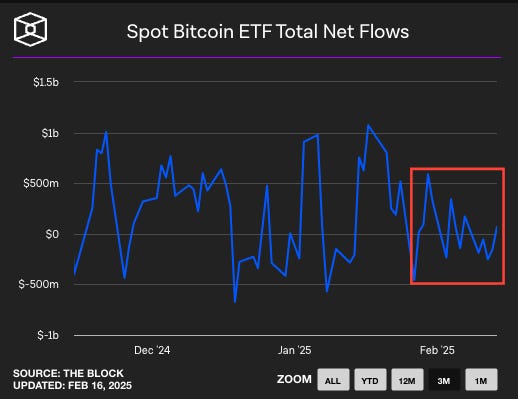

A clear indicator of this is the decline in Bitcoin ETF inflows. Since the end of January, net inflows into Bitcoin ETFs have consistently tapered off, signalling reduced institutional demand.

What Could Break the Stalemate?

The next major catalyst that might shake Bitcoin from this consolidation is the FTX repayments, which are set to begin in the coming days. A sudden injection of capital from repaid creditors could see many of them buying back into the crypto market, potentially giving Bitcoin the boost it needs to break out.

What to Do During Choppy, Boring Price Action

When the market is stagnant, it’s best to step away from the charts, focus on other things, spend time with loved ones, and enjoy yourself. Until Bitcoin decisively breaks out of this range, there isn’t much to see.

For those who simply can’t stay away—just buy Bitcoin.

Stormrake Spotlight: Ondo Finance (ONDO) ($1.28)

Ondo is showing signs of slipping deeper into an accumulation phase, having failed to reclaim the 0.5 Fibonacci level and the 21 & 55 EMAs, both of which would have flipped momentum in favour of the bulls.

A key level of interest is $1.25—the 0.382 Fibonacci retracement, which has acted as strong support for the past month. Ondo has tested this level six times, with each attempt being rejected. If this support holds again, we could see a bounce.

BTC/USD Key Levels and Price Action:

Bitcoin is currently hovering just above the key $95.7K support level after falling below all major moving averages. This level has held throughout the entire consolidation period, but if it breaks, we could see a drop to $92.5K. On the upside, Bitcoin needs to reclaim $100K to regain bullish momentum.

BTC Total ETF Flows for 16 Feb: $ (data not available)

(ETF flow data is sourced from https://farside.co.uk/btc/ and reflects figures at the time of writing.)

ETH/USD Key Levels and Price Action:

Ethereum is testing a breakdown of all major moving averages while trading mid-range. If the 200 SMA fails to hold, ETH could drop to the range low of $2,556. However, a bounce from this level could trigger momentum, sending ETH toward the range high of $2,865.

ETH Total ETF Flows for 16 Feb: $ (data not available)

(ETF flow data is sourced from https://farside.co.uk/eth/ and reflects figures at the time of writing.)

*All prices are denominated in USD unless stated otherwise*

Written by Alexandar Artis

To view this article and many others on our blog - please click HERE

If you enjoyed this Morning Note, feel free to open an account and gain access to more proprietary research and work with your very own dedicated crypto broker.

Disclaimer

All statements made in this material are made in good faith and we believe they are accurate and reliable. Stormrake does not give any warranty as to the accuracy, reliability or completeness of information that is contained here, except insofar as any liability under statute cannot be excluded. Stormrake, its directors, employees and their representatives do not accept any liability for any error or omission in this newsletter or for any resulting loss or damage suffered by the recipient or any other person. Unless otherwise specified, copyright of information provided in this newsletter is owned by Stormrake. You may not alter or modify this information in any way, including the removal of this copyright notice.