Dead cat bounce

Overnight the markets had a brief rally following the Friday's smackdown. This move is likely just a small mean reversion before further stress testing of key support levels.

The information contained here is for general information only. It should not be taken as constituting financial advice. Stormrake is not a financial adviser. You should consider seeking independent financial advice prior to making any personal investments.

Stick to the strategy

What we are witnessing from last night’s brief relief rally may merely be a weak response to a savage sell-off. I would also caution investors to be wary of being overly bullish heading into September. Bitcoin has struggled historically posting an avg. Sept performance of -6.3% over the last 9 years. For buyers of bargains and those who DCA their Bitcoin allocation, this should be seen as an excellent opportunity, we just need to make sure there is dry powder available to capitalise on the discount.

Bitcoin key levels

BTC currently trades just above $20kUSD and its recent rally didn’t show a lot of strength which indicates we can possibly trade sideways until another catalyst occurs.

The sideways range would have us trade between 20k and 20.7k, a tight 4% range makes sense following Friday’s heavy sell-off. Be mindful of breaking the recent lows as we could quickly head towards 18.9k.

Ethereum key levels

As highlighted in yesterday’s Morning Note, $1,422 was an absolutely pivotal level to retain. As we didn’t spike lower, it gave ETH the impetus to make a strong move to the upside. The next level of resistance comes in where the sell-off started at $1,700.

If we fail to trade higher and revisit the recent lows and break below them, a sharp move to the next key support level of $1,241 should be expected.

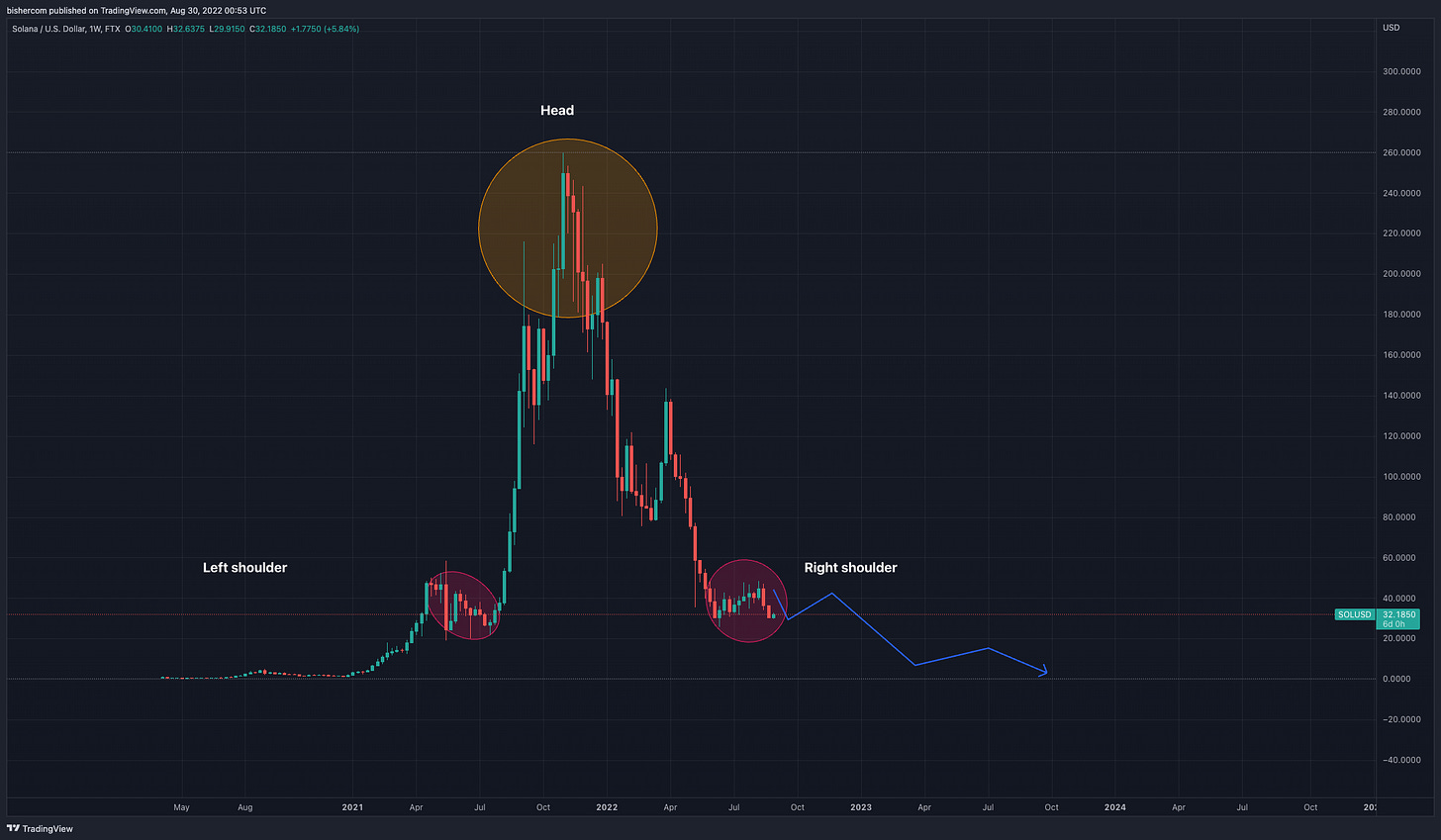

Solana H&S pattern update

Solana is now tracking quite nicely along the Head & Shoulders pattern we pointed out at $45. We are currently trading at $32 after a small bounce from the local lows of $30. A swing to the upside retesting the $45 level can be anticipated within this pattern before a complete breakdown towards $6, especially considering the current macro environment is quite dour.

Disclaimer

All statements made in this material are made in good faith and we believe they are accurate and reliable. Stormrake does not give any warranty as to the accuracy, reliability or completeness of information that is contained here, except insofar as any liability under statute cannot be excluded. Stormrake, its directors, employees and their representatives do not accept any liability for any error or omission in this newsletter or for any resulting loss or damage suffered by the recipient or any other person. Unless otherwise specified, copyright of information provided in this newsletter is owned by Stormrake. You may not alter or modify this information in any way, including the removal of this copyright notice.