Danger, Will Robinson!

The current market conditions remind me of a show called 'Lost in Space' where a family of 5 must find their way home. There is danger ahead but opportunity awaits the intrepid investor.

The information contained here is for general information only. It should not be taken as constituting financial advice. Stormrake is not a financial adviser. You should consider seeking independent financial advice prior to making any personal investments.

Let us begin our journey

We have a number of challenges ahead this week, primarily coming from the US inflation data set to come out this Wednesday at 10:30pm AEST and we also have markets digesting quite grim data across the board.

To recap, this is what we are currently facing:

1. 8% of listed houses reduced asking price over last month, most since 2000

2. Credit card debt up 20% in 3 months

3. Most aggressive rate hikes in history into a recession

4. China-US tensions escalating

5. Inflation at 40-year high

Despite the current outlook being less than ideal, risk assets have been quite defiant and have continued to chug along either trading sideways or continue to catch a bid. This doesn’t mean we’re in the clear yet and could be more of an indication of seller exhaustion and the ‘Great Bear’ is simply resting before resuming its mauling of valuations. For some context DOGE and SHIB have a combined MC of a near $16B.

CPI Public Enemy #1

For risk assets catching a bid now heading into CPI week can be the market front-running expectations of cooling inflation as the headline print is expected to come in at 8.7% - a whole 4 bps lower than the previous print. This doesn’t bode well though for the blind side, where if we get a print above consensus or even a higher print than the previous 9.1%, risk assets are most likely to be sold en masse as expectations of larger rate hikes will then be loaded into the FEDs revolver.

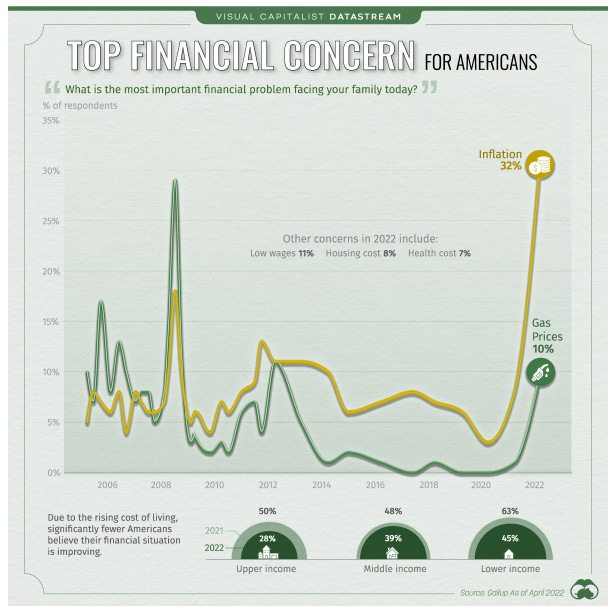

A recent survey shows how >50% of Americans considers their top financial concern to be related to inflation (be it directly or via gas prices & low real wages). This highlights the massive political pressure in the US to tame the inflation beast and will give less reason to worry about asset valuations.

Bitcoin recap

The return of the CRAB! Sideways price action has returned and we are trading in a tight range between 22.5k and 23.5k. A lot of traders were expecting more volatility and previous swing lows would have had us retesting 21.1k by now. This will likely end on Wednesday night. For now don’t rule out the retest of the swing low of 21.1k and if we get a lower than expected inflation print come in then we’ll be watching for a sharp move to 25k.

What we need

I wanted to leave this Morning Note on a lighter tone as I don’t want the warnings above to be misconstrued as wanting lower prices. I just want our readers to stay informed of the dangers ahead and be mindful of any risks.

I saw an edited version of Maslow’s hierarchy of needs come across my Twitter and it reminded me of what basic human need I have yearned for for the last 8 months.

Disclaimer

All statements made in this material are made in good faith and we believe they are accurate and reliable. Stormrake does not give any warranty as to the accuracy, reliability or completeness of information that is contained here, except insofar as any liability under statute cannot be excluded. Stormrake, its directors, employees and their representatives do not accept any liability for any error or omission in this newsletter or for any resulting loss or damage suffered by the recipient or any other person. Unless otherwise specified, copyright of information provided in this newsletter is owned by Stormrake. You may not alter or modify this information in any way, including the removal of this copyright notice.