Crypto is alive and well in Australia

The Stormrake team has returned from the Australian Crypto Convention and we have plenty of research and insights to pass on to our readers. In today's Morning Note we also prepare for the FOMC meet.

The information contained here is for general information only. It should not be taken as constituting financial advice. Stormrake is not a financial adviser. You should consider seeking independent financial advice prior to making any personal investments.

Australian Crypto Convention 2022

“The Australian Crypto Convention provided us with such a high quality signal. We’re deep in a bear market, yet there are so many established businesses and upcoming entrepreneurs building up the Aussie crypto industry.“

- Douglas Hemingway, Stormrake technical director

Australian senator, Andrew Bragg who was at the convention, has released a draft bill called ‘Digital Assets (Market Regulation) Bill 2022 and has asked for input from the industry as to what else is required or what can be simplified. Stormrake will be sharing our insights on how we can protect investors as an industry, whilst maintaining a free and open industry.

We’re extremely proud to be a part of the digital asset revolution.

Stay tuned for more updates coming out of the convention.

Now onwards, we must prepare for the FED.

Macro outlook ahead

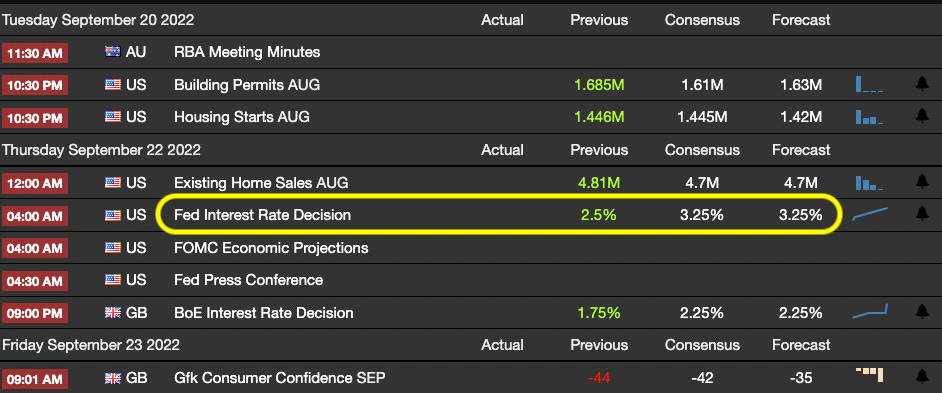

There isn’t all that much activity this week, except for the king of all macro events. The FED meeting. Expect some volatility across the AUD with the RBA meeting minutes release, as well as some action on the GBP with the BoE interest rate announcement. Markets are pricing in a 75bps rate hike, with a potential 100bps coming out of the FED meeting. This could be bearish for crypto asset prices, especially if we get a super hawkish Powell talking down market expectations.

Now is not the time to be rushing into market orders but be patient with some limit orders ready to fire.

The merge narrative gets dusted

ETH open interest has been absolutely smoked over the last few days. It has reduced by over $2.2 billion USD as traders unwind positions and reality meets expectations. This will cause some short-term volatility with a likely slow decrease in price as interest in ETH evaporates. This doesn’t mean we have to be pessimistic, it may just mean ETH investors get the opportunity to secure 3 digit ETH.

BTC/USD key levels

A small pump and fade back to previous levels is all the price action we received over the weekend. We’re now chopping around the key level of $19,560 USD, nothing will happen with this market until we get a greater than 5% move in either direction. Should a 5% pump or dump occur it puts us at the first key support and resistance levels of $18,549 and $20,554 respectively.

Directionally trading Bitcoin when we reach these levels will be quite easy, for if we get a break and daily close above/below those key levels, a trader can look to trade a directional breakout. Don’t get blindsided trying to directionally trade BTC pre-FOMC, prepare your strategy and then execute.

ETH/USD key levels

Ethereum continues its power slide to the down side following the “sell the news” event post merge. On Friday we published a key level break of $1,422 USD will lead us to finding support at $1,333 which is the exact level we’re trading at currently. For investors who read this Morning Note, you can use the levels as potential areas for spot limit orders and identify potential demand zones. Be prepared for further sell pressure as the next key level is $1,241, about 6.5% away from current prices. Losing this level and it’s lights out until $1,002. For the bulls to stage a rally, we need a daily close above $1,422 for a slow continuation to $1,620.

Disclaimer

All statements made in this material are made in good faith and we believe they are accurate and reliable. Stormrake does not give any warranty as to the accuracy, reliability or completeness of information that is contained here, except insofar as any liability under statute cannot be excluded. Stormrake, its directors, employees and their representatives do not accept any liability for any error or omission in this newsletter or for any resulting loss or damage suffered by the recipient or any other person. Unless otherwise specified, copyright of information provided in this newsletter is owned by Stormrake. You may not alter or modify this information in any way, including the removal of this copyright notice.