Control thy emotions

Important macroeconomic data is being released this week and as traders we must see through the veil to not let the numbers dictate our emotions

The information contained here is for general information only. It should not be taken as constituting financial advice. Stormrake is not a financial adviser. You should consider seeking independent financial advice prior to making any personal investments.

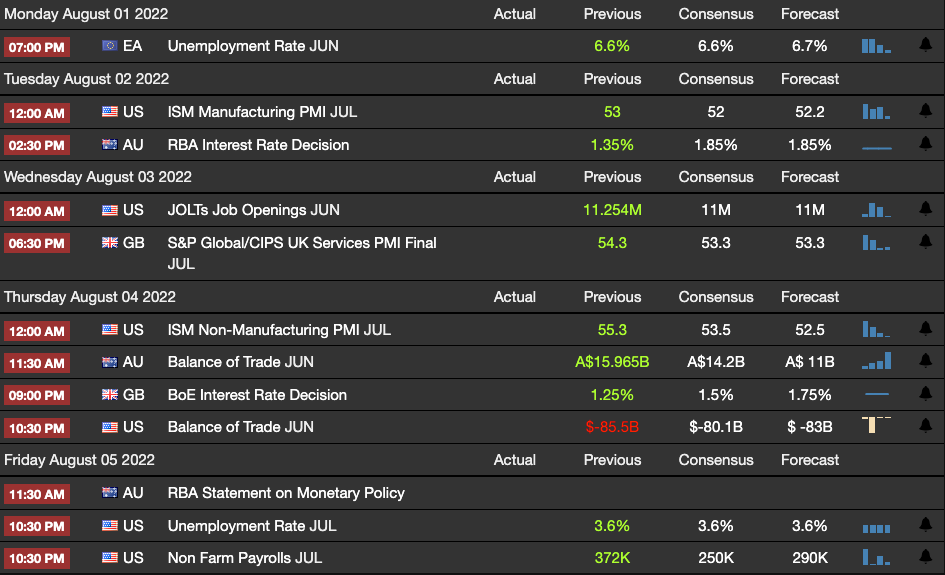

Macro data

We can see here the 4 key data points to track will be the interest rate announcements coming out of the UK and AUS as well as the unemployment data coming out of the EU and the US.

This will prove to be an adequate testing ground for the bulls risk appetite as equities and crypto have previously rallied on hot CPI numbers and interest rate rises. Should the data come out and show increases in unemployment or we get larger than expected interest rate hikes but the markets continue to rally, this should be a clear indication that we are going to witness a strong bear market relief rally.

Spreads you can park a bus through

The US 2yr yield is offering 2.88% whilst the US 10yr yield last printed 2.65% providing markets a massive 23bps spread and a deeply inverted yield curve, mind you this is one of the financial markets strongest tools for predicting a recession. This data flies in the face of the US governments attempt at narrative control that there is no recession nor is there one coming but I’m not here to debate definitions, I’m here to point the intrepid crypto investor in the right direction.

ETC vs ETH

This chart has so many setups and narratives built into it, I personally think it’s a traders paradise. For example, if you’re an ETH maxi and big believer in Vitalik, you can short ETC and long ETH, if you’re a narrative trader you can short ETH and long ETC to play the “Return to the original chain” play, for macro bears, they can short ETC as it has massively outperformed the wider crypto asset class and finally for momentum bulls they can simply hop on to the fastest horse and long ETC.

I’m not here to tell you which play would suit you best but to encourage you to run your own analysis and comment below what you think will run best.

Disclaimer

All statements made in this material are made in good faith and we believe they are accurate and reliable. Stormrake does not give any warranty as to the accuracy, reliability or completeness of information that is contained here, except insofar as any liability under statute cannot be excluded. Stormrake, its directors, employees and their representatives do not accept any liability for any error or omission in this newsletter or for any resulting loss or damage suffered by the recipient or any other person. Unless otherwise specified, copyright of information provided in this newsletter is owned by Stormrake. You may not alter or modify this information in any way, including the removal of this copyright notice.