Calm before the storm

Despite some crazy headlines coming out of crypto land the last few days, the market response has been generally muted. Let's unpack what this means

The information contained here is for general information only. It should not be taken as constituting financial advice. Stormrake is not a financial adviser. You should consider seeking independent financial advice prior to making any personal investments.

Bitcoin market structure

The expanding channel that Bitcoin has been trading in since setting its yearly low is still clearly being respected. What has been slightly ominous is the swing highs and lows within the channel having been getting shallower, this is despite the fact that we have had some less than savoury economic data come out plus events such as bridge hacks and wallets being drained.

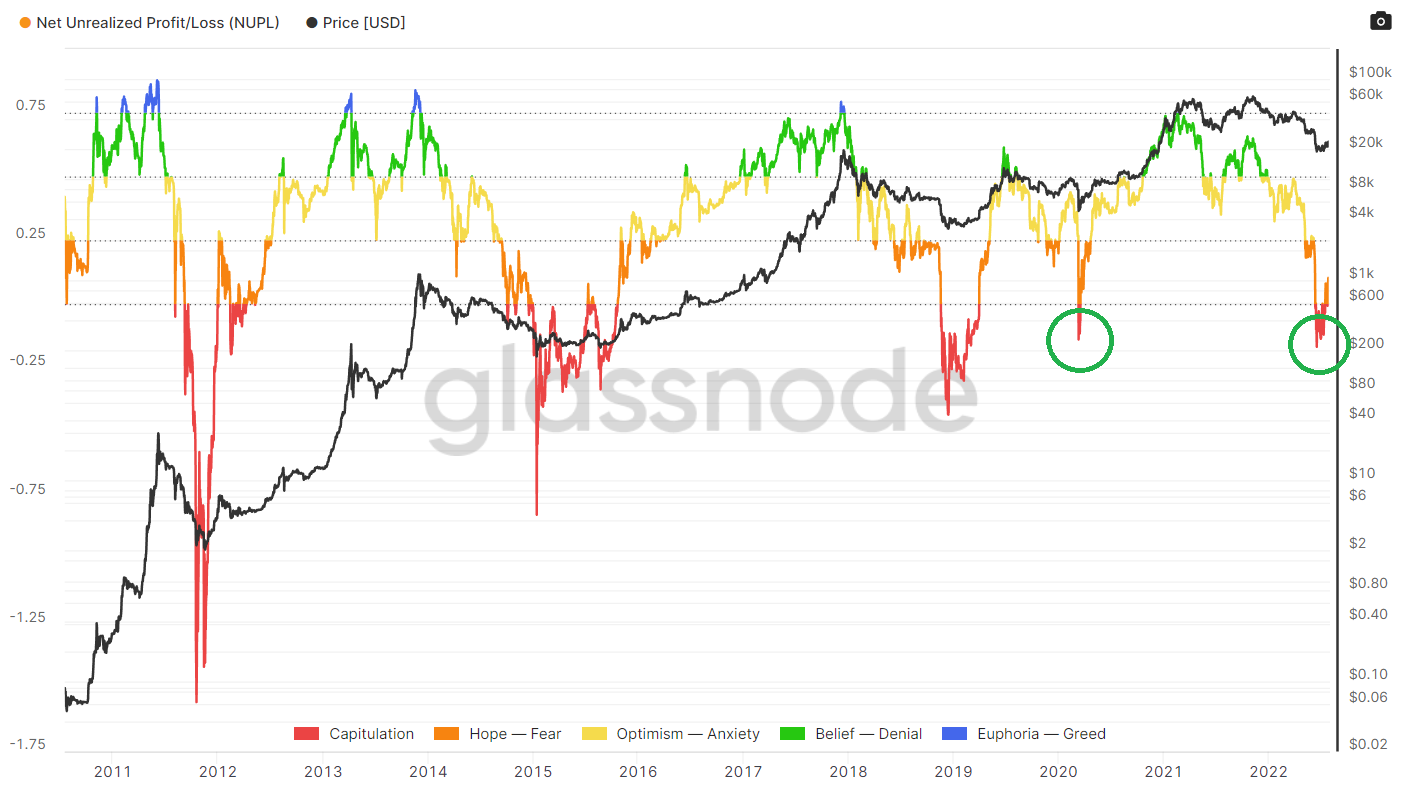

For the Bitcoin bulls, they will chalk this up to a win after being beaten up for the last 6 months and is being lauded as a sign of potentially higher prices. This is further compounded by the NUPL metric. It compares unrealised profits to unrealised losses. We have witnessed such a severe drop in profitability that we can easily call it capitulation. It also resembles what we saw during the covid crash.

Bear force 1

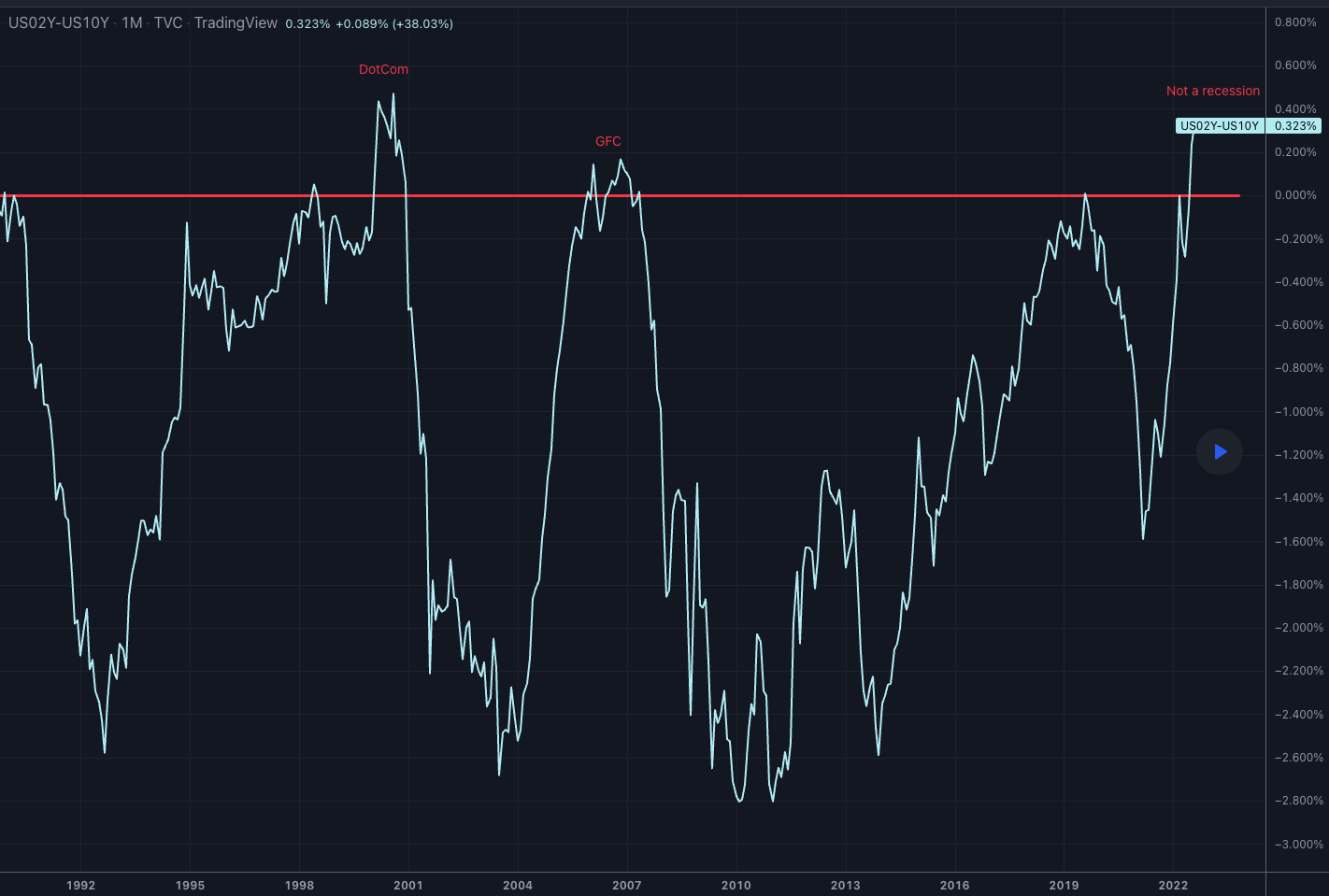

For the bears though there is the impending recession, that despite the US governments best efforts and mental gymnastics are looking unlikely to avoid.

Pictured above is the 10Y to 2Y TBond Yield spread and they are signalling a recession with levels not seen since the GFC. Markets know it, Consumers know it, but the government is in denial.

There are significant challenges for the wider crypto ecosystem as they battle with massive fully diluted valuations (FDV). Looking at BitDao for example, a token that aims to be “a collective of builders and stakeholders enabling mutually beneficial Web3 ecosystems of people, products, and public goods” trading with a market cap of 700mill but a FDV of nearly 7 billion dollars, a simply outrageous valuation for a highly speculative project.

The middle path

Right now the best approach is to walk the middle path, what this means is to not fall into the trap of being hyper bullish or hyper bearish but to be balanced in your view of the market. Right now, prices across Bitcoin and Ethereum despite their recent rallies would be quite attractive for crypto investors, especially for those in underwater positions as dollar cost averaging from current levels will greatly help their overall portfolio. Tempering that enthusiasm by not branching out the risk curve and diving into projects that have had a recent price pump and FDVs that are simply mind melting, will allow the intrepid crypto investor to survive the ongoing crypto winter.

Disclaimer

All statements made in this material are made in good faith and we believe they are accurate and reliable. Stormrake does not give any warranty as to the accuracy, reliability or completeness of information that is contained here, except insofar as any liability under statute cannot be excluded. Stormrake, its directors, employees and their representatives do not accept any liability for any error or omission in this newsletter or for any resulting loss or damage suffered by the recipient or any other person. Unless otherwise specified, copyright of information provided in this newsletter is owned by Stormrake. You may not alter or modify this information in any way, including the removal of this copyright notice.