Bullish Response Towards Soft Inflation Data

US YoY inflation data came 20 bps under expectations for a print of 7.1% whilst core inflation came in at an even 6%. This gave the markets the impetuous for a strong move to the upside.

The information contained here is for general information only. It should not be taken as constituting financial advice. Stormrake is not a financial adviser. You should consider seeking independent financial advice prior to making any personal investments.

US Inflation Hits Turning Point

US inflation as seen in the orange line in the chart above appears to be slowing down. For comparison, Australia's inflation rate (blue) has been added in and we can see that our local inflation rate is exceeding that of the US. This could be a potentially leading indicator as a sign of global inflation cooling and that the tightening regime by central banks has started to have an effect on the rate of inflation. We need to be conscious though that this doesn't mean rate increases are going to stop, we also need to be mindful that a "FED pivot" usually precedes a severe market rout. Risk assets are yet to have clear ground o receive a structural bid from the market but the macro environment is becoming slightly less hostile.

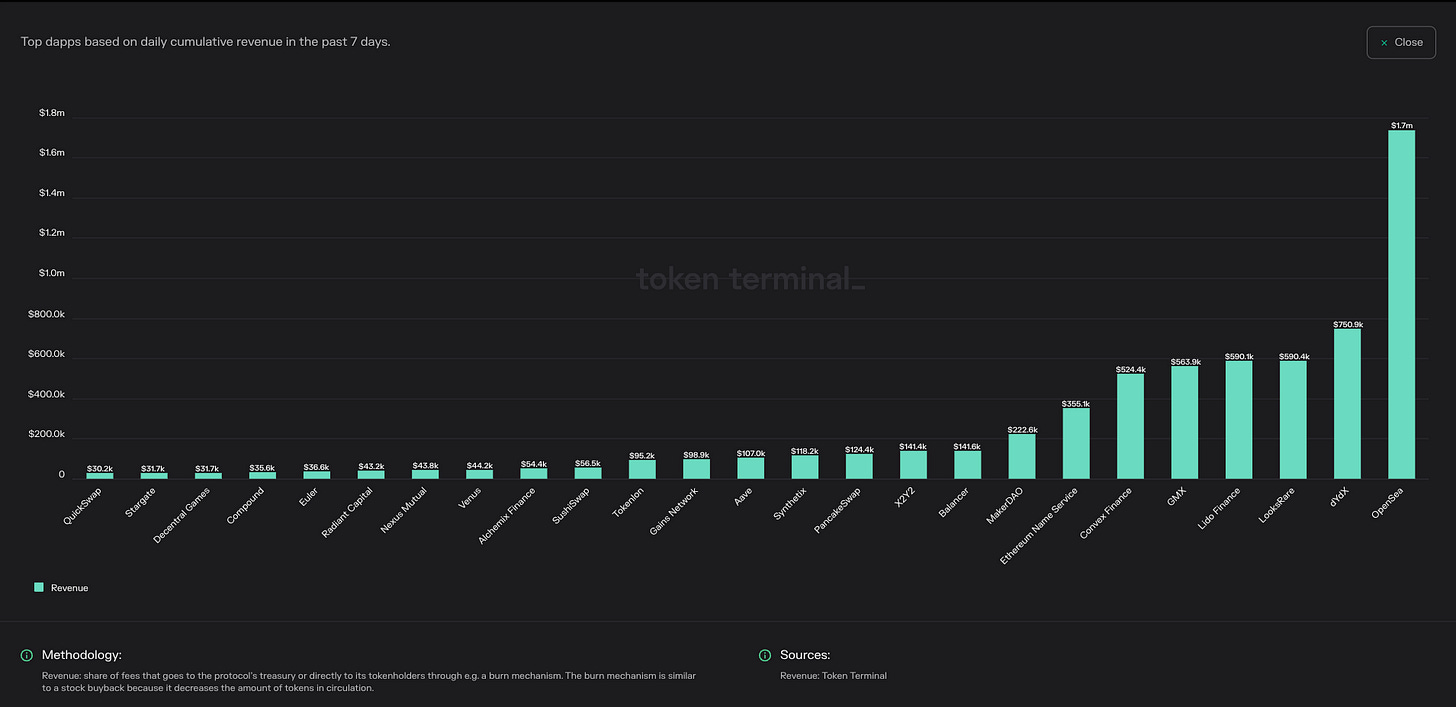

dApps Keep Earning Revenue

Whilst we live deep in crypto winter it can be hard to notice the budding green shoots of a developing industry. Many NFT marketplaces, decentralised exchanges, perpetual and leverage trading platforms keep on producing revenue and increasing the value to token holders through their user activity. This was not a reality in previous bear markets and goes to highlight the growth the crypto economy has had despite the significant levels of fraud and deception by centralised businesses such as FTX and Celsius. As always, bear markets are for building and we encourage our readers to keep an eye out on these productive apps.

BTC/USD Key Levels

Bitcoin has shot through and reclaimed the key level of $17,300 USD and is now poised for a strong move to the upside. Should we break through $18,217 then we can expect a move towards $19,673 before resistance kicks in. The move from $18,217 to $19,673 represents a 7.5% move and can occur quite quickly. To the downside, watch for a breakdown below $17,300 for if it happens, a retest of $16,500 cannot be ruled out.

ETH/USD Key Levels

Ethereum has finally reclaimed $1,300 USD and looks set to test the next levels of resistance. Should we hold above $1,300 the next retest will occur $1,386 and if we break and close above this level then watch for a sharp move towards $1,472. To the downside, if we lose $1,300 on the daily timeframe, we can expect a retest of $1,190. Should the sell off be considerable, major support kicks in at the $1,071 key level.

To view this article and many others on our blog - please click HERE

If you enjoyed this Morning Note, feel free to open an account and gain access to more proprietary research and work with your very own dedicated crypto broker.

Disclaimer

All statements made in this material are made in good faith and we believe they are accurate and reliable. Stormrake does not give any warranty as to the accuracy, reliability or completeness of information that is contained here, except insofar as any liability under statute cannot be excluded. Stormrake, its directors, employees and their representatives do not accept any liability for any error or omission in this newsletter or for any resulting loss or damage suffered by the recipient or any other person. Unless otherwise specified, copyright of information provided in this newsletter is owned by Stormrake. You may not alter or modify this information in any way, including the removal of this copyright notice.