Bitcoin Soars to $93.9k as Altcoins Stumble

Bitcoin hits a new all-time high of $93.9k as most altcoins pull back

It may feel like an eternity since the last all-time high, yet it was just five days ago. During this time, numerous narratives have driven the market. New meme coins have emerged with astronomical returns, while established ones continue to set new highs. “Dino” coins like Cardano and Ripple have surged, rewarding those who remained confident in these projects. Newer entrants like Sui and Ondo have also rallied, with Sui achieving fresh all-time highs and Ondo positioning itself to retest its current high in the near future.

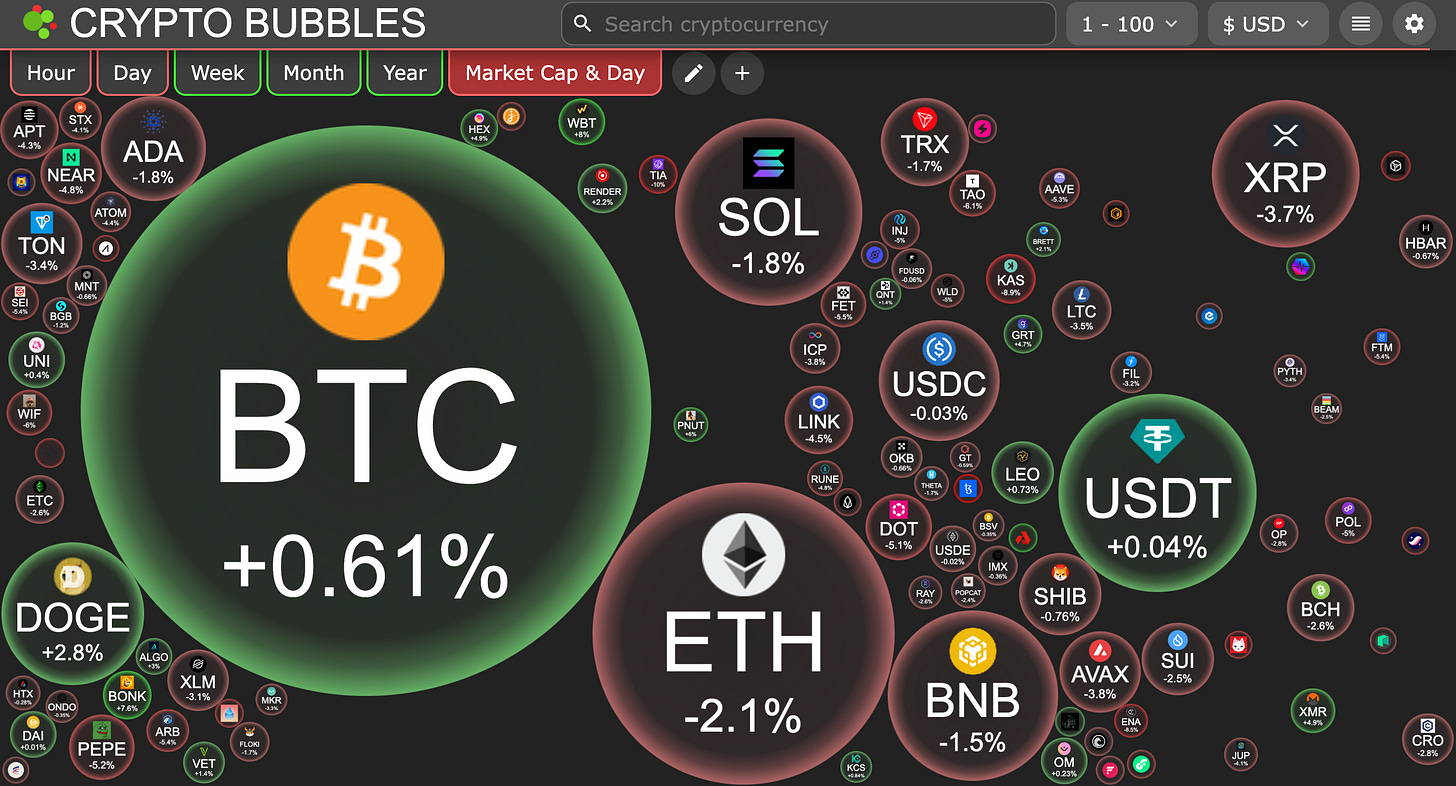

Today, Bitcoin reached another all-time high at $93.9k. While Bitcoin climbed higher over the past 24 hours, the majority of the top 100 cryptocurrencies experienced a pullback. This trend has strengthened Bitcoin’s dominance, which has reclaimed 60% after briefly dipping below that level yesterday.

We remain in the first phase of the bull market, where Bitcoin dominates and altcoins deliver mixed performances. Until we see a significant decline in Bitcoin dominance, we remain in this initial phase. However, this does not mean altcoins won’t perform well—some may even outperform Bitcoin. Sui stands out as a prime example, consistently leading the charge. Coins like this should be on your watchlist, as they are likely to spearhead altseason when the time comes.

For those feeling underexposed or concerned about missing out, now is an opportune time to strengthen your Bitcoin position. The market remains early in its cycle, offering long-term believers in crypto a prime entry point. Contact your Stormrake Crypto Broker to seize these golden opportunities.

Stormrake Spotlight: ONDO ($1.007)

Ondo continues to show strength, reaching a high of $1.086 yesterday before the broader altcoin market corrected. These small corrections should be viewed as opportunities to buy stronger coins, as they are likely to outperform once the market regains momentum. Ondo appears to be one of these outperformers.

BTC/USD Key Levels and Price Action:

Bitcoin reached a new all-time high of $93.9k early this morning but has since experienced a sharp pullback. BTC is currently trading between the 21- and 55-EMA supports, which are expected to hold. If these levels fail, a retest of the $90k key support level—reinforced by the 200-SMA—could occur. Despite this, the structure and trend remain bullish.

BTC Total ETF Flows for 19 Nov: $ N/A million

(ETF flow data is sourced from https://farside.co.uk/btc/ and reflects figures at the time of writing.)

ETH/USD Key Levels and Price Action:

As Bitcoin rallied, most altcoins, including Ethereum, pulled back. Unfortunately, ETH was once again rejected at the critical CPR level of $3,220, triggering a bearish crossover and a fall below all moving averages. Ethereum remains in a neutral price structure but leans bearish based on these indicators. Resistance remains at $3,220, while support is at $3,000.

ETH Total ETF Flows for 19 Nov: $ N/A million

(ETF flow data is sourced from https://farside.co.uk/eth/ and reflects figures at the time of writing.)

Written by Alexandar Artis

To view this article and many others on our blog - please click HERE

If you enjoyed this Morning Note, feel free to open an account and gain access to more proprietary research and work with your very own dedicated crypto broker.

Disclaimer

All statements made in this material are made in good faith and we believe they are accurate and reliable. Stormrake does not give any warranty as to the accuracy, reliability or completeness of information that is contained here, except insofar as any liability under statute cannot be excluded. Stormrake, its directors, employees and their representatives do not accept any liability for any error or omission in this newsletter or for any resulting loss or damage suffered by the recipient or any other person. Unless otherwise specified, copyright of information provided in this newsletter is owned by Stormrake. You may not alter or modify this information in any way, including the removal of this copyright notice.