Bitcoin Eyes New All-Time Highs Ahead of Trump’s Inauguration

Bitcoin has decisively broken out of its month-long consolidation period, setting the stage for further highs.

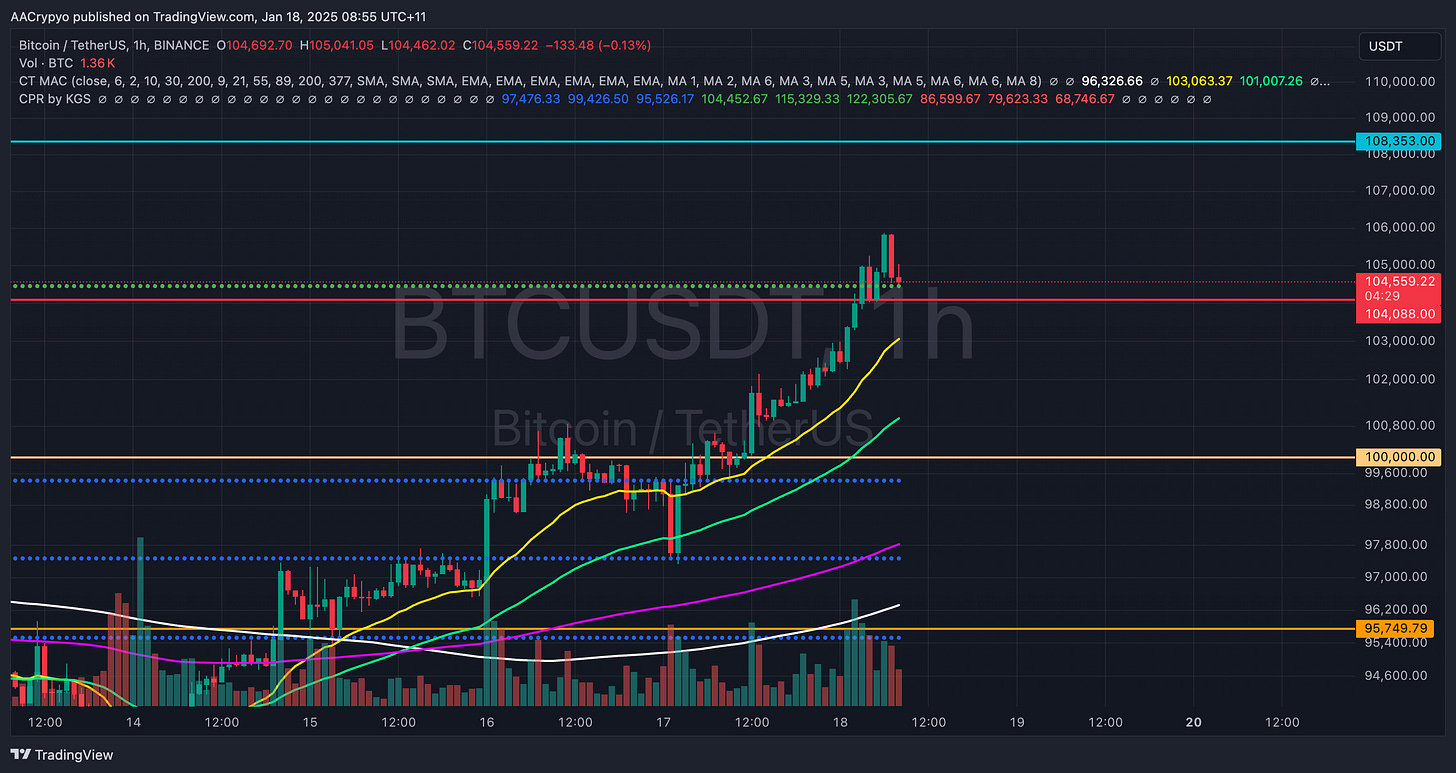

As mentioned yesterday, Bitcoin was battling to stay above the key level and the top of the month-long consolidation range of $100k. It’s safe to say Bitcoin has won that battle and is now positioning itself to set new all-time highs, potentially as soon as January 20—or even earlier.

The past week has been quite the ride for Bitcoin. Initially, it appeared that we might witness a sustained pullback below $90k, driven by bearish news that the US Department of Justice (DOJ) had been cleared to sell $6.5 billion worth of seized Bitcoin. However, this narrative was quickly overturned by heavy buying activity, which saw Bitcoin touch a low of $89.2k. Since then, Bitcoin hasn’t looked back. It has surged 18% from that low in just four days, supported by mass buying and a weaker-than-expected inflation data set released on Thursday morning. Yet, the biggest catalyst of all still lies ahead.

We’ve been tracking the potential impact of Trump’s inauguration for what feels like every day this past month—and for good reason. Many anticipate this to be a bullish event for Bitcoin, particularly as reports suggest Trump is poised to sign a pro-crypto executive order on his first day in office. Unsurprisingly, Bitcoin has already rallied on the hype surrounding this development and could skyrocket further if that executive order is indeed signed on day one. With Bitcoin less than 3.5% away from its all-time high, it wouldn’t be surprising to see it achieve new highs before Trump even takes office. The "Trump Pump" could very well be the catalyst Bitcoin needed to ignite its momentum and really start the 2025 bull market.

Stormrake Spotlight: HeyAnon (ANON) ($20.26)

AI-related tokens have experienced a pullback after dominating the market in recent weeks. Currently, HeyAnon (ANON) is down 20% from its all-time high set just two days ago. However, it’s now consolidating around a key psychological level of $20. If a base can be established at this level and the anticipated Trump Pump materialises, ANON could rally higher once again.

BTC/USD Key Levels and Price Action:

Bitcoin has not only cleared the critical $100k level but has also broken through the key resistance at $104k, which is now being flipped into support. This $104k level is essential for Bitcoin to hold if it aims to create a new all-time high. Encouragingly, the rising 21-EMA is nearing $104k, reinforcing the support and providing an additional buffer.

BTC Total ETF Flows for 17 Jan: $ (data not available)

(ETF flow data is sourced from https://farside.co.uk/btc/ and reflects figures at the time of writing.)

ETH/USD Key Levels and Price Action:

Ethereum has managed to break above its key resistance level of $3,370 and is currently contending with the mid-CPR resistance level at $3,515. If ETH can successfully breach this CPR resistance, the next target lies at $3,557. On the downside, the 21-EMA and 55-EMA should act as key supports for ETH. Should these levels fail to hold, a pullback to the $3,370 key level would be expected.

ETH Total ETF Flows for 17 Jan: $ (data not available)

(ETF flow data is sourced from https://farside.co.uk/eth/ and reflects figures at the time of writing.)

*All prices are denominated in USD unless stated otherwise*

Written by Alexandar Artis

To view this article and many others on our blog - please click HERE

If you enjoyed this Morning Note, feel free to open an account and gain access to more proprietary research and work with your very own dedicated crypto broker.

Disclaimer

All statements made in this material are made in good faith and we believe they are accurate and reliable. Stormrake does not give any warranty as to the accuracy, reliability or completeness of information that is contained here, except insofar as any liability under statute cannot be excluded. Stormrake, its directors, employees and their representatives do not accept any liability for any error or omission in this newsletter or for any resulting loss or damage suffered by the recipient or any other person. Unless otherwise specified, copyright of information provided in this newsletter is owned by Stormrake. You may not alter or modify this information in any way, including the removal of this copyright notice.