Bears are in trouble if BTC reaches this Level...

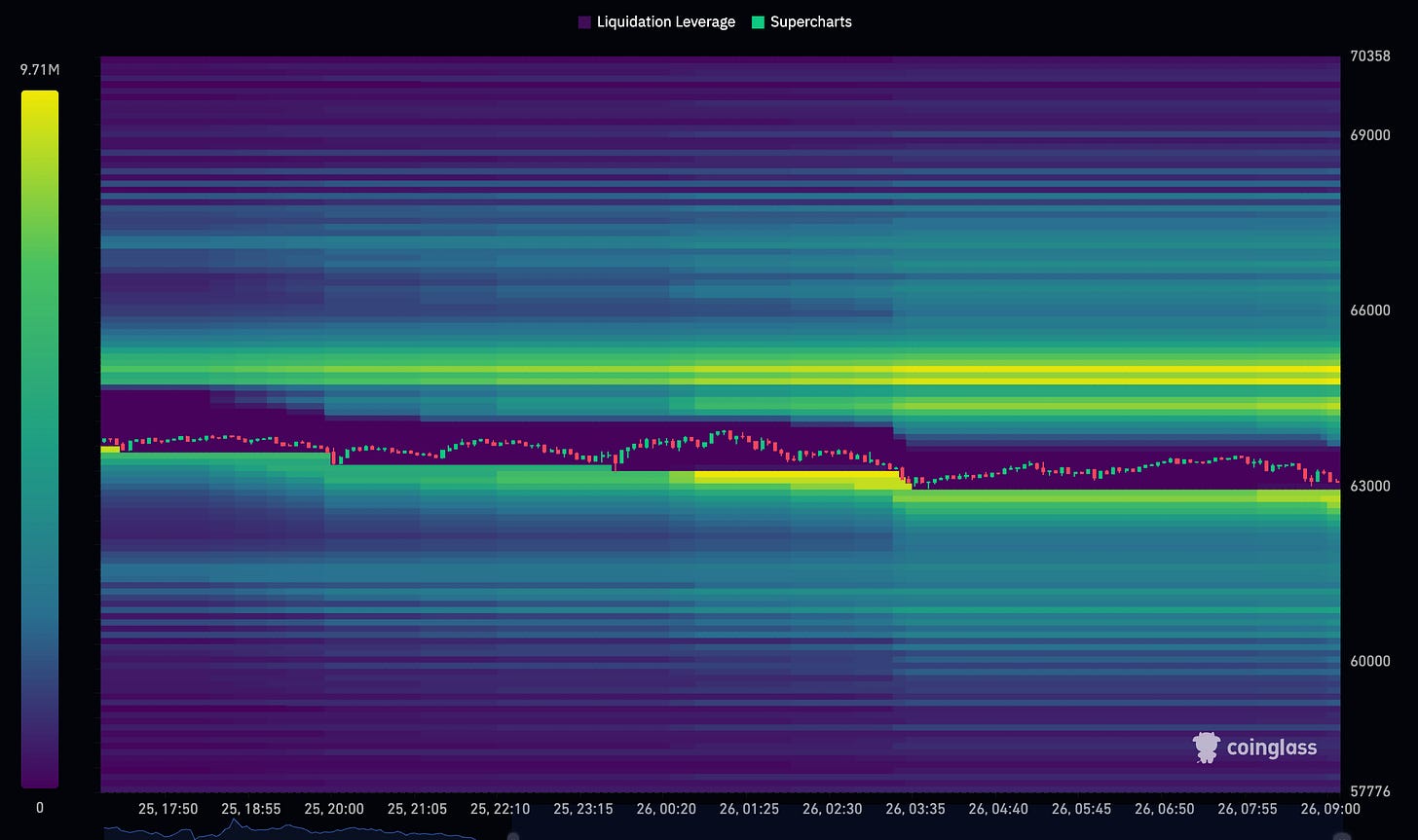

If BTC is to reach 65k then $75 million of short leveraged positions will be liquidated.

$65,000 is the golden number for Bitcoin bears. Over $75 million worth of short-leveraged positions are vulnerable and set to be liquidated if BTC reaches that level. We saw Bitcoin attempt a rally toward $65k, but it failed, as bears pushed the price back down to just above $63.1k, flipping the threat to the bulls.

Bears still have a couple of defensive levels before a wipeout occurs and BTC potentially runs up to $66.8k. In the meantime, leveraged long positions are at more imminent risk, with over $30 million set to be liquidated if BTC falls to $62.7k. A fall to this level would likely see BTC retest the key support level of $60.1k.

Stormrake Spotlight: ETHEREUM ($2,570)

The entire market has pulled back after BTC failed to hold above $64k, leading ETH to follow suit with a 3% drop overnight. This pullback presents a potential buying opportunity at key support, allowing traders to allocate accordingly.

BTC/USD Key Levels and Price Action:

Once again, the Bitcoin bulls failed to prevail, with BTC briefly breaking above $63.8k but failing to hold the level. Despite reaching a peak of $64.8k, bears successfully pushed prices back down, defending the previous lower high on the daily chart, key liquidation levels, and flipping both the 21- and 55-day EMAs back to a bearish stance. With BTC showing signs of weakness under this key level and the bearish cross of the EMAs, a retest of $60.1k seems more likely than a breakout to $66.8k.

BTC Total ETF Flows for 25 Sep: $ - 45.3 million

(ETF flow data is sourced from https://farside.co.uk/btc/ and reflects figures at the time of writing.)

ETH/USD Key Levels and Price Action:

After seven bullish days out of the last eight, Ethereum is showing its first sign of weakness. The pullback to $2,556 was triggered by bearish divergence, though this level should provide support, as both 200-day moving averages align with it. While there is a small concern with the bearish cross of the 21- and 55-day EMAs, the confluence of support at this level still provides hope for the bulls.

ETH Total ETF Flows for 25 Sep: $ + 27.4 million

(ETF flow data is sourced from https://farside.co.uk/eth/ and reflects figures at the time of writing.)

Written by Alexandar Artis

To view this article and many others on our blog - please click HERE

If you enjoyed this Morning Note, feel free to open an account and gain access to more proprietary research and work with your very own dedicated crypto broker.

Disclaimer

All statements made in this material are made in good faith and we believe they are accurate and reliable. Stormrake does not give any warranty as to the accuracy, reliability or completeness of information that is contained here, except insofar as any liability under statute cannot be excluded. Stormrake, its directors, employees and their representatives do not accept any liability for any error or omission in this newsletter or for any resulting loss or damage suffered by the recipient or any other person. Unless otherwise specified, copyright of information provided in this newsletter is owned by Stormrake. You may not alter or modify this information in any way, including the removal of this copyright notice.